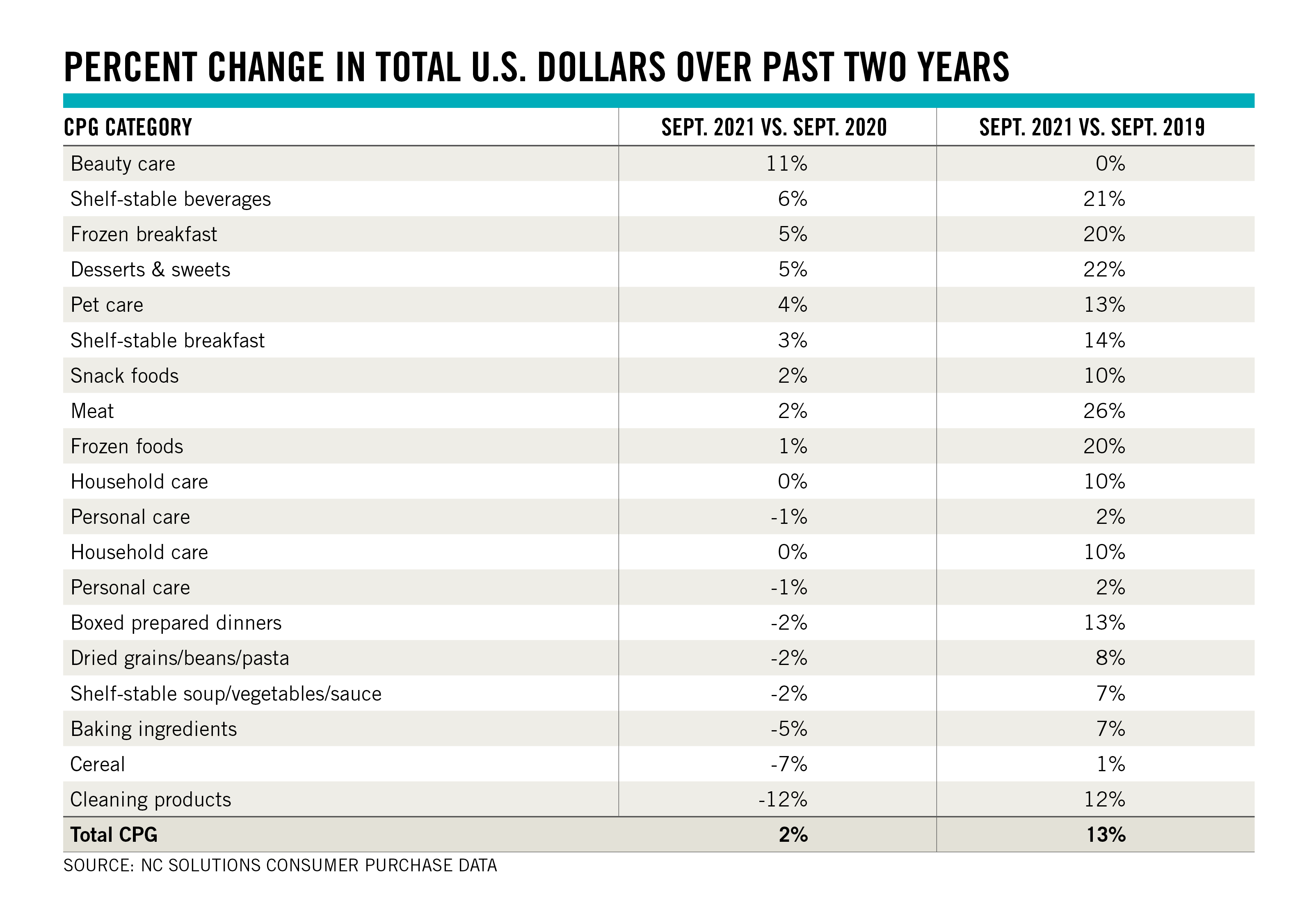

Americans spent 2% more year-over-year on groceries and consumer packaged goods (CPGs) in September 2021, and 13% more compared to September 2019, according to new data provided to Supermarket News by NCSolutions.

The September data shows the percent change in U.S. consumer spending for key center store categories comparing September 2021 to September 2020 levels, as well as September 2021 to September 2019.

According to NCSolutions, “We provide both 2019 and 2020 comparisons because spending for some categories may be down compared to the anomaly of the heavy spending in 2020 due to the initial surge during the start of the pandemic — but they’re still very elevated compared to pre-pandemic shopping in 2019.”

As the table above shows, the CPG landscape is looking quite different in September 2021 than it did one year prior. Still, one consistent theme is that total U.S. consumer CPG spending is still elevated — though not nearly as dramatically — as consumers continue to consume more meals at home, as noted in categories such as frozen and shelf-stable breakfast, packaged meat and frozen foods, which saw dollar spend increase on top of last year’s surge. For example, U.S. consumers spent 5% more on frozen breakfast in September 2021 compared to September 2020, and 20% more compared to September 2019 levels.

Other highlights of NCSolutions’ September 2021 center store data:

• Beauty care — which saw declines in the first year of the pandemic — has rebounded, with September 2021 sales 11% greater year-over-year.

• Pet care has become a bigger priority (+4% year-over-year) as consumers provide for pets old and new.

• U.S. consumers did not stock their pantries at the same levels as last year, with spending slightly down on dried grains and beans and shelf-stable soup down 2% year-over-year in September 2021. September household care spending was flat and cleaning product spend was down 12% year-over-year. But consumers are stocking up on shelf-stable beverages (+6% year-over-year in September).

• Consumers have grown tired of baking compared to the sourdough extravaganza of last September (September baking ingredient spending decreased 5% year-over-year), and are instead loading up on pre-made desserts and sweets (up 5% year-over-year).

• Consumers sought more convenience in the breakfast daypart this back-to-school season, with frozen breakfast items up 5% and shelf-stable breakfast items up 3% year-over-year in September 2021. But they’ve tired of ready-to-eat cereal, which saw 7% year-over-year declines this past September.

NCSolutions’ robust consumer CPG purchase dataset consists of the industry’s leading comprehensive sources. This includes data from its parent companies (for example, Nielsen Retail Measurement Services and Nielsen’s National People Meter). NCS also sources point-of-sale data from a unique set of retailer partners.