The economic recovery is under way — but whether or not supermarkets are on board remains a matter of debate.

The early signs of a thaw in consumer spending haven't given food retailers much cause for optimism yet, according to projections by retailers in a survey conducted by SN.

More than two-thirds — about 68% — said they think consumer spending will be about the same in 2010 as it was in 2009. Most of the other respondents said they think spending will be marginally better than last year, and only 1.8% expect spending to improve significantly.

The economy also remains retailers' biggest fear in terms of a threat to their business in 2010, with 60.6% selecting reduced spending from high unemployment and weak consumer confidence as a bigger threat than competition from non-traditional operators. Only 28.4% cited non-traditional food retailers as a bigger threat than weak consumer spending, and only 7.3% said deflation was the biggest threat.

Although economists are projecting that the retail industry — hit hard by the economy in 2009 — began to rebound in the fourth quarter and will continue to do so in the year ahead, some also seem to agree with the somewhat pessimistic outlook by supermarket operators that the impact will be minimal for the food-retailing industry.

“One of the things we expected to see was a return in spending for small-ticket discretionary items such as apparel, and this is indeed what has happened,” Frank Badillo, senior economist for Retail Forward, Columbus, Ohio, told SN. “In fact, some of that bounce-back has even been a little stronger in some areas than we expected. However, I don't expect some of the food categories will bounce back that quickly or that strongly compared with some of these other categories, where people have cut back the most, and postponed purchases the most, in discretionary categories such as apparel.”

He said consumers have indicated that they have some pent-up demand for buying things like apparel and some home furnishings, and that they expect to spend money on those in the next six months.

“That will be far less the case in some of these non-discretionary categories, the basic categories like food and staples. The bounce-back that will emerge and play out over the year will be much more modest in some of those categories, particularly as shoppers have learned how to cut back in the last few years, and they want to maintain those frugal shopping habits.”

Overall, however, Badillo said he projects that the improvement in total retail sales that occurred during the holiday season “will be sustained over the first half of the year and then pick up steam in the second half of the year.”

“We don't see a big sustained pickup, but some modest growth persisting in the initial months of the year,” he said, projecting retail growth — excluding auto and gasoline sales — of about 1.5% to 2% in the first half of the year, and then accelerating to 3% to 4% growth in the second half of the year.

“We see job and income growth resume by mid-year, helping to drive some second-half growth,” he said. “Clearly, the key to a continued pickup in confidence will have to be from the job market, and we are seeing some good trends there, not only in unemployment claims, but in new jobs, particularly in service jobs, which tend to be the leading indicator.”

He pointed out that service-job growth turned positive in two of the last three months.

“If we see those job trends sustained, we should see overall job growth by mid-year, and income growth will follow,” he said.

Ongoing Frugality

Humphrey Taylor, chairman of the Harris Poll, a division of Harris Interactive, New York, told SN last week that based on the most recent consumer survey, retailers have good reason to be pessimistic.

“There is absolutely no sign of consumers increasing spending in the short term,” he said, noting that businesses focused on low prices stand the best chance of reaping gains in this environment. “Consumers are definitely focused on cost. Obviously, value is also an important issue, but in this environment, we believe cost will trump value in a lot of cases.”

In order for consumer spending to improve, the employment picture must get better, Taylor agreed.

“It doesn't seem to matter how much the economy improves, this frugality among consumers will remain until employment picks up,” he told SN.

The recent economic forecast issued by the National Retail Federation, Washington, indicates some positive signs concerning employment, however, and therefore consumer spending.

Rosalind Wells, chief economist at NRF, said the association is projecting that the economy will grow at a pace of 2.5%-3% in 2010, driven by gains in exports, government spending and a return to more traditional levels of inventory.

“Consumer spending will lag overall economic growth, but will continue to expand at a moderate 2% to 2½% rate,” she said.

Even though unemployment levels remain high, “the size of the job losses has diminished,” Wells said.

“Improvement should continue this year,” she continued. “As the labor market improves, so should consumer income, which is the single most important ingredient for consumer spending. This will bolster consumer confidence and lead to increases in consumer spending.”

Increases are expected to be moderate, however.

“Until consumers see unemployment ticking down, and jobs being added, and incomes going up, and the value of their homes increasing, they will remain cautious,” Wells said.

The housing market, which has been depressed for almost two years, is “now showing some signs of life,” she added, which could also give a lift to consumer confidence.

Household wealth, which was hit hard in 2009, has begun to recover in 2010, Wells pointed out.

“However, most consumers, who have been more frugal, will continue to seek out value,” she added. “Discounters and warehouse clubs will continue to be favored destinations.”

At the other end of the income spectrum, she noted that high-end retailers have started to report gains. This could be due in part to the recovery of the stock market in 2009, benefiting upper-income consumers.

“Those people in that upper-income category were frightened because they had lost money in the stock market or in the value of their homes,” Wells said. “This past year, the market came back a great deal, home values look like they hit the bottom and may increase this year, so those people — who were never in dire shape to begin with — have started feeling a little better.

“That's the kind of thing we expect will happen to other income groups as the economy improves. It will filter down to everyone else who still has a job and the income to spend.”

Wells projected that retailers aimed at middle-income consumers would remain under pressure in 2010, although those retailers can expect some modest improvement over a year ago.

Retail sales — excluding restaurants, autos and gasoline — fell by 2.5% in 2009, according to NRF, although a surprising uptick in the holiday season bolstered optimism for the new year, Wells said, projecting a reversal of 2009's results, or a positive 2.5% gain in retail sales, for 2010.

Andrew Wolf, a Richmond, Va.-based analyst with BB&T Capital Markets, said he believes supermarket performance already bottomed out in the fourth quarter of 2009, and will gradually improve throughout the year.

“By the third and fourth quarters, we will see a reasonable recovery,” he told SN.

Although low inflation could be a boon to most retailers because it allows more consumer spending, it presents challenges for supermarket operators, analysts pointed out.

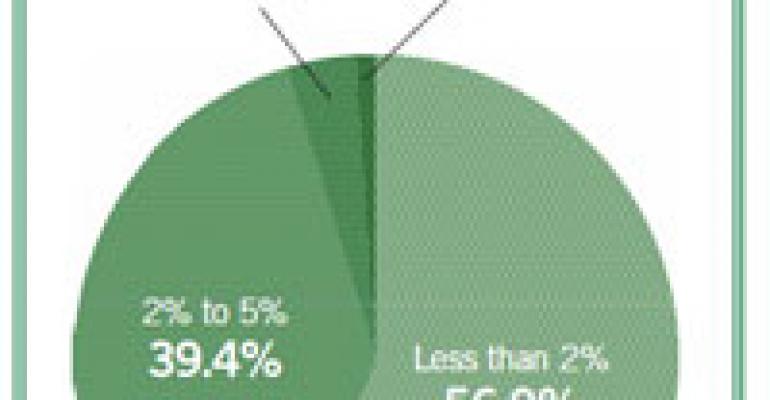

More than half of retailers in SN's survey — 56% — said they are expecting food inflation be less than 2% in 2010, after a year in which retailers struggled to boost their top lines with little or no help from food-price increases.

Most of the rest of the survey respondents — 39.4% of the total — said they expect food inflation to rise between 2% and 5% in 2010, and a few — 3.7% — said they expect food-cost inflation to be above 5%.

The pressure on the bottom lines of food retailers will continue as well, poll respondents said. More than two-thirds of retailers — 68.8% — in the survey projected that their profit levels would be about the same or lower than a year ago, with 30.3% projecting a decline in profitability and 38.5% expecting profits to remain at 2009 levels.

Most of the rest — 29.4% — said they expect profits will increase only slightly.

Price Wars

Retailers also indicated they are poised to continue to sacrifice margins with sharp pricing in 2010, a balance that many food retailers struggled with in 2009. While Cincinnati-based Kroger Co., for example, opted to pursue traffic with aggressive prices at the expense of profitability, others, like Jacksonville, Fla.-based Winn-Dixie Stores, sought to moderate the impact on margins with selectively reduced prices.

More than 70% of retailers in the survey said they planned more price-focused advertising in 2010, with most of those — 57.8% of the total — saying they would increase price-focused advertising “a little” vs. 13.8% who said they expected to increase such messaging “a lot.”

Deborah Weinswig, an analyst with Citigroup, New York, in a research report on the outlook for 2010, predicted an “all-out price war” among supermarket operators this year, citing aggressive moves by Wal-Mart that will keep traditional supermarkets under pressure.

“There will likely be further price investments from food retailers and gross margin pressure as they scramble to match Wal-Mart's aggressive pricing in 2010,” she wrote. “We believe that what the food retailers experienced in 2009 was the result of a ‘modern day’ price war, and we expect an ‘old time’ price war to break out in 2010.”

In other indications that food retailers have a somewhat pessimistic outlook on the year in terms of consumer spending, nearly half — 48.6% — said they expect the trend of smaller baskets to continue in 2010, albeit accompanied by more frequent customer visits.

This trend was cited by several supermarket operators in financial conference calls throughout 2009, as shoppers shunned discretionary purchases and traded down, but also dined out less and so prepared more meals at home.

Another 22% of respondents to the SN survey said they expect both basket sizes and customer counts to decline in 2010, compared with 2009.

Only 29.3% said they expected larger basket sizes in 2010, and of those, most — 18.3% of the total — said they expect increases both in customer counts and basket sizes.

Private-label penetration is also is expected to increase in 2010, according to the survey, but at a slower pace.

Nearly 100% of retailers in the survey reported an increase in dollar sales of private-label in 2009, including 36.7% who said such sales increased by between 2% and 5%. A sizable portion — 14.7% — said the private-label sales were up by more than 5%.

Those percentages tapered off slightly when retailers were asked about their expectations for 2010. Only 33% said they expect gains of between 2% and 4% in private-label dollar sales, and only 8.3% said they expect gains of more than 5% in 2010.

The reported 2009 results follow pretty closely the predictions offered by retailers in last year's survey, when about 62% of respondents projected private-label dollar-sales gains of 2% or more.

Retailers also seem to be expecting more aggressive responses from vendors this year, as more than half — 53.2% — said they expect vendors to both sharpen prices on a widespread basis to better compete with private labels, and to introduce more new products or special deals to target shoppers on a tight budget.

What is your outlook for consumer spending in the year ahead?

| It will be even worse than 2009 | 16.5% |

| It will be about the same as 2009 | 51.4% |

| It will be marginally better than 2009 | 0.3% |

| It will be significantly better than 2009 | 1.8% |

What is your outlook for profitability in the year ahead?

| Profits could be down in 2010 | 30.3% |

| Profit levels will remain about even with a year ago | 38.5% |

| Profits will increase slightly over 2009 levels | 29.4% |

| Profits will increase significantly in 2010 | 0.9% |

| No answer | 0.9% |

What is the biggest threat to your top-line sales growth in 2010?

| Low consumer confidence and high unemployment leading to reduced spending | 60.6% |

| Competition from non-traditional supermarket operators | 28.4% |

| Deflation will persist | 7.3% |

| Other | 3.7% |

Which of the following actions do you expect overall from vendors in 2009?

| They will sharpen prices on a widespread basis to better compete with private labels | 21.1% |

| They will introduce more new products or special deals to target shoppers on a tight budget | 16.5% |

| Both of the above | 53.2% |

| None of the above | 9.2% |

Which of the following are you projecting for 2010, compared with 2009?

| Increases in both customer counts and basket sizes | 18.3% |

| Increases in customer counts, but smaller baskets | 48.6% |

| Decreases in customer counts, but larger baskets | 11.0% |

| Decreases in both customer counts and basket sizes | 22.0% |

METHODOLOGY: The charts and tables on these pages were created based on a survey of retailers conducted by SN from Feb. 1-12. The surveys were conducted via email to subscribers of SN's daily electronic newsletter. The data include responses from 109 retailer respondents.