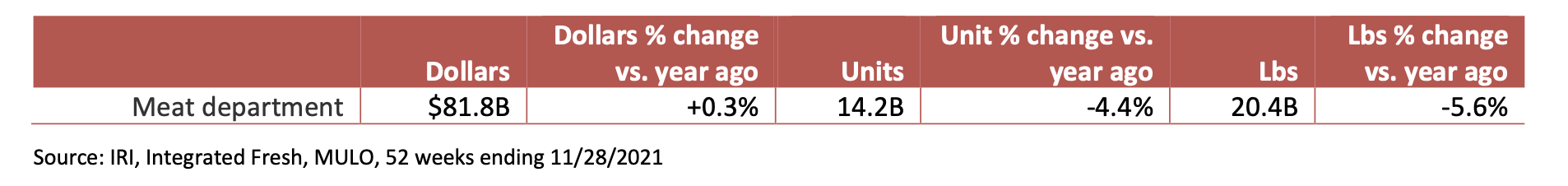

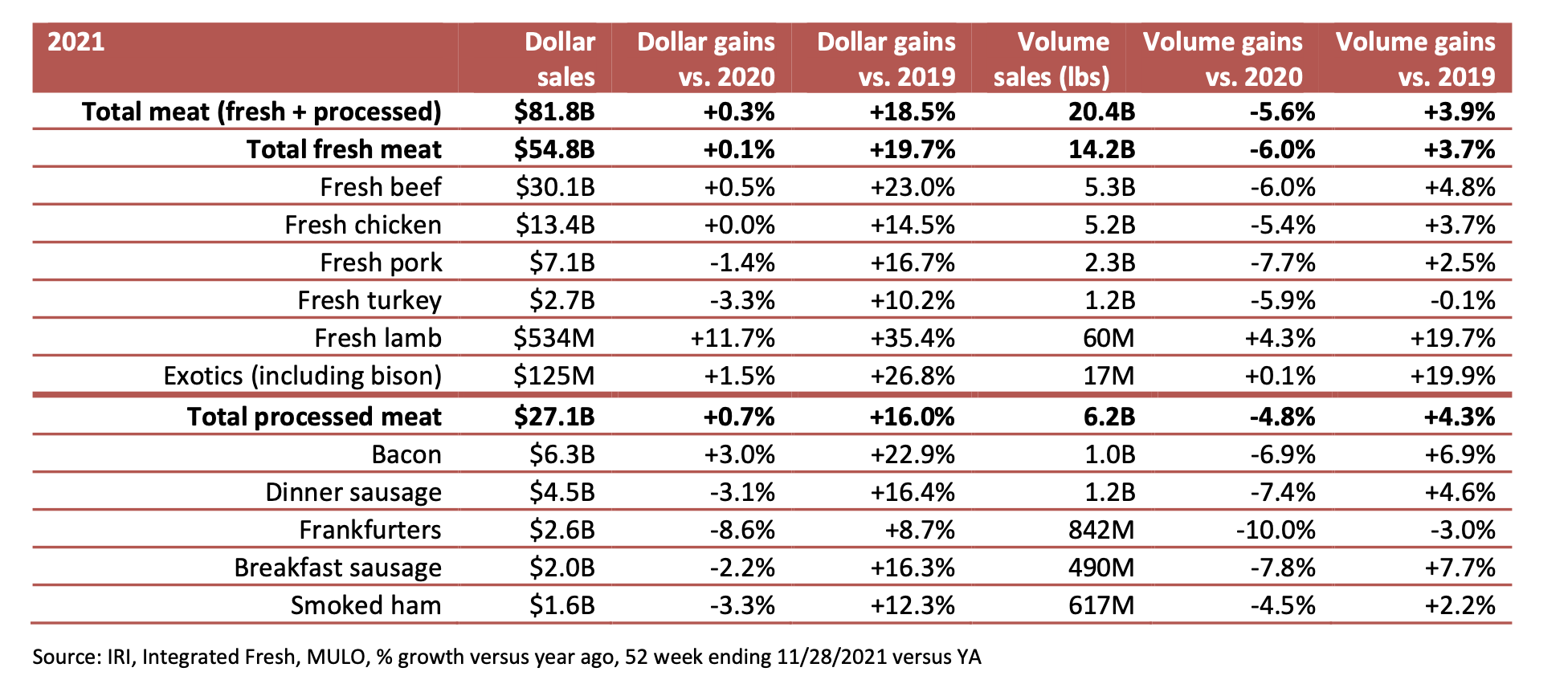

Following the record-breaking sales of meat due to the impact of the pandemic in 2020, dollar sales continued to rise in 2021, with an 0.3% increase for a total of $81.8 billion in sales — though those numbers were driven by significant inflation, according to the 2022 Power of Meat report released Tuesday. Tellingly, volume and unit sales fell short of the prior-year record levels, at -5.6% and -4.4%, respectively.

“In 2020, consumers purchased different amounts, brands, types and cuts of meat and poultry. Above all, they bought more meat and poultry than they ever had, creating a very difficult path for growth in 2021,” noted the annual study, which was conducted by 210 Analytics on behalf of FMI—The Food Industry Association and the Meat Institute’s Foundation for Meat and Poultry Research and Education.

Still, taking 2020’s record sales as an outlier, volume sales in 2021 were up 3.9% when compared to pre-pandemic levels. This increase is due, in part, to several grocery shopper trends resulting from the COVID-19 pandemic, including increased home cooking, record-high online shopping and a shift to digital sources for recipe inspiration, according to the report.

“The Power of Meat shows Americans continue to count on meat’s taste, quality, convenience and value throughout another unusual and challenging year,” said Julie Anna Potts, president and CEO of the Meat Institute.

While beef and chicken have dominated meat department sales for a long time, since the onset of the pandemic, beef’s share has increased in both dollars and volume on very strong ground beef and premium cut sales. Beef dollar sales were more than all the other fresh meat categories combined in 2021.

In processed meat, bacon and dinner sausage were the big sellers. Bacon dollars gained both year-on-year and versus 2019, but was the only processed meat category to do so. With the exception of hot dogs, processed meat did move more pounds in 2021 than in 2019.

According to the Power of Meat, 74% of Americans describe themselves as meat eaters. Meat department visits declined slightly less this year (50.4 visits per shopper per year), but shoppers spent a little more during each trip. In response to higher prices and inflation pressures, shoppers are eating out and ordering in from foodservice less often, while trying to recreate restaurant experiences at home instead, and have adjusted retail meat purchase habits. Volume remains significantly above pre-pandemic levels for fresh (up 3.7% since 2019) and prepared meats (up 4.3% since 2019). Fresh beef volume increased nearly 5% since 2019, bacon 7%, and fresh lamb sales increased nearly 20%. More meat consumers shopped online than ever (61%, up from just 39% in 2019), and nearly half of meat shoppers (46%) today shop online regularly.

In other findings, Americans are eating 80% of meals at home (down from 88% at the pandemic peak in April 2020), and 57% prepare four to seven dinners per week with meat. More than half of meat shoppers (51%) say websites, apps and social media are their top resources for meat preparation advice. Of those who search online for meat cooking tips and ideas, 72% use Google or another search engine and 57% use YouTube. Pinterest, Instagram and TikTok are particularly popular with Generation Z and Millennials — used by around half of shoppers in those generations for discovering meat preparation inspiration. For example, 53% of Gen Z find meat inspiration on TikTok, compared to just 4% of Boomers. The top three searches for all generations are by type of meat, specific cuts and specific preparation methods (like air fryers).

“Shoppers’ meat IQ is higher than ever, and the Power of Meat shows they are looking for even more ways to purchase meat and get inspiration for preparing meals,” said Rick Stein, vice president of fresh foods for FMI. “Retailers are constantly working to give shoppers more choices in the meat department and further enhance in-store and online shopping options.”

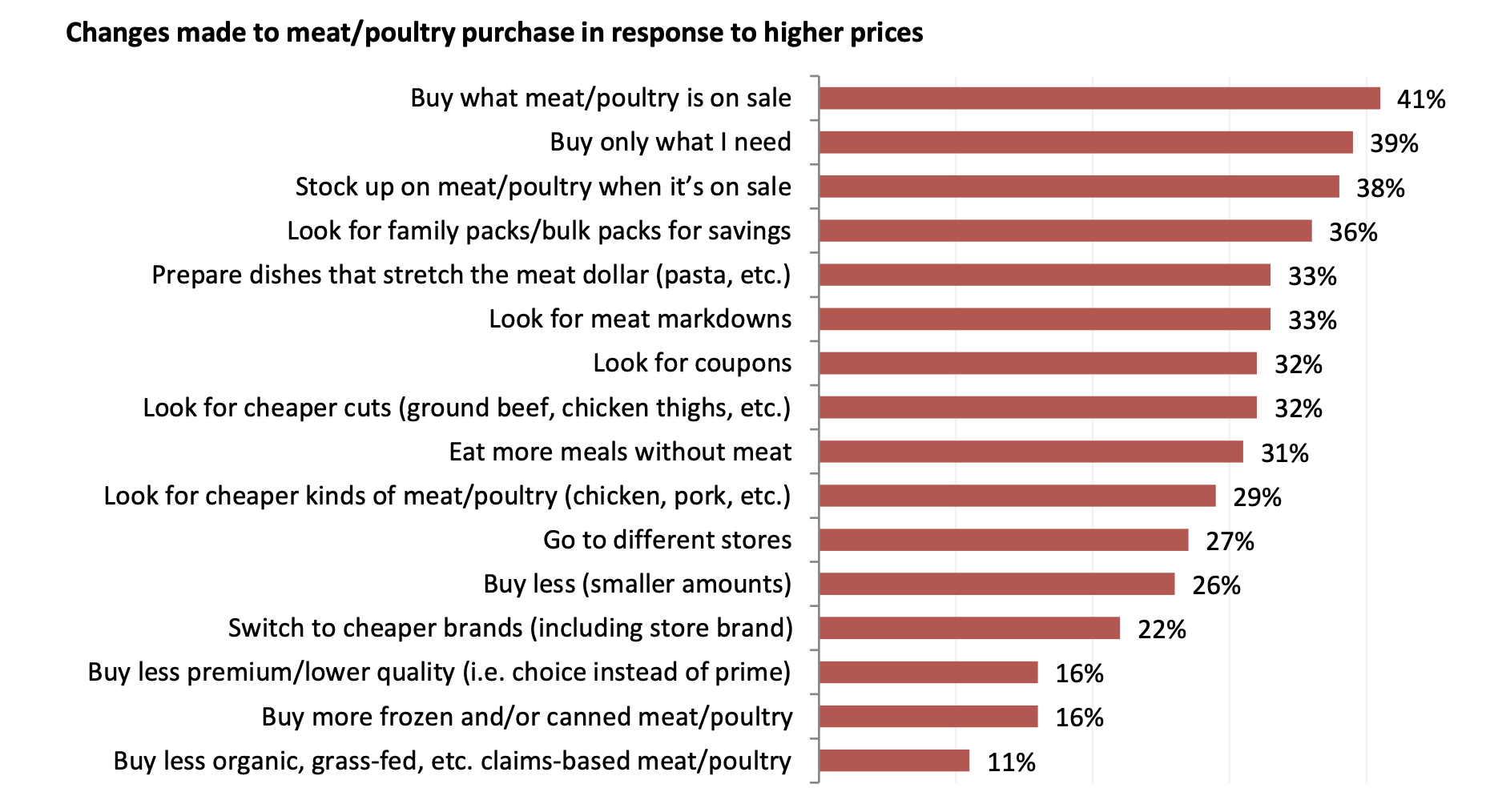

The widespread supply chain disruption across categories combined with extensive consumer media coverage has consumers very aware this time. For instance, three-quarters of consumers noted that the cost of groceries and the cost of meat/poultry is up over the past few months, with the survey fielding mid-December. At the same time, 43% are seeing fewer meat and poultry promotions.

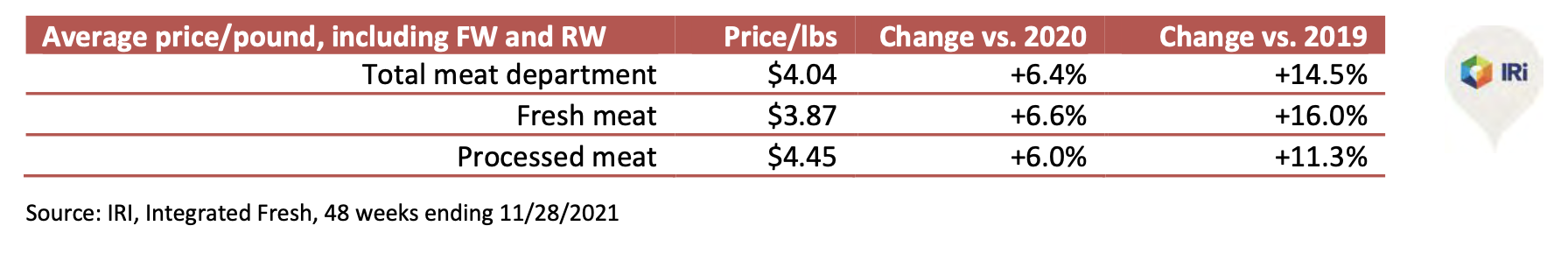

In December 2021, the U.S. Bureau of Labor Statistics reported the largest year-on-year increase in inflation in 40 years. The consumer price index increased 7.0%. IRI data shows price increases across protein commodities. In January through November 2021, meat prices across all species, fixed and random weight, averaged $4.04, which was up 6.4% versus 2020 and +14.5% versus 2019.

Both retailers and the rest of the meat supply chain have struggled with labor shortages throughout 2021. In a survey with retailers by 210 Analytics, 91% of grocery retailers cited having trouble filling meat department openings or having enough labor to cover all available labor hours. While all have made overtime available, 39% have resorted to shortening service counter hours and some retailers have shortened store opening hours altogether, though often on a store-by-store basis.

Consumers, by and large, have not noticed a marked difference in available assistance in the meat department, with the bulk of purchases coming from the self-service case. About one-quarter (23%) noted less available assistance.

In all, 89% of consumers have noted some changes to their meat department, whether more out-of-stocks, fewer available cuts, etc. In turn, the changed market conditions resulted in changed meat purchases for 58% of shoppers, with above average shares for urban and rural shoppers.

Shoppers who made a change selected an average of three reasons why they bought differently. Out-of-stocks of certain protein kinds, followed by non- availability of specific cuts, were top reasons for making changes to the typical meat purchase. Lack of desired package sizes and looking for something a little cheaper were frequently cited reasons as well. Experimentation, which was prevalent in 2020, was a minor reason, at 10%.