Shares of Amazon stock jumped over 5% in after hours trading, following the release of the retail giant’s first quarter results, which beat analyst expectations with earnings of $1.13 per share and $143.3 billion in revenue.

The revenue figure is a 13% increase over its first-quarter 2023 revenue of $127.4 billion and beat Wall Street analyst estimates of $0.83 per share on revenue of $142.55 billion.

The Seattle-based company’s North American segment sales were up 12% to $86.3 billion from the same period in 2023, and international segment sales were up 10% to $31.9 billion.

Net income reached $10.4 billion in Q1 for $0.98 cents per diluted share, more than tripling the first quarter 2023 results of $3.2 billion and $0.31 per diluted share.

Amazon said in its earnings report that it anticipates net sales to grow by 7% to 11% year over year in the second quarter of 2024 to between $144 billion and $149 billion.

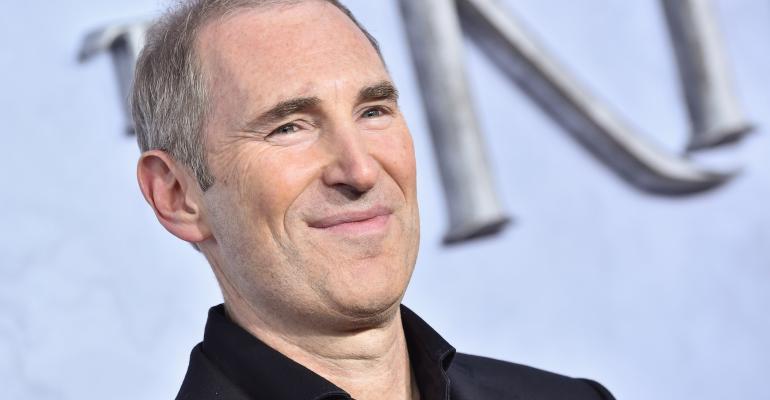

“It was a good start to the year across the business, and you can see that in both our customer experience improvements and financial results,” said Andy Jassy, Amazon President and CEO, in a statement. “Our stores business continues to expand selection, provide everyday low prices, and accelerate delivery speed (setting another record on speed for Prime customers in Q1) while lowering our cost to serve; and, our advertising efforts continue to benefit from the growth of our stores and Prime Video businesses.”

While much of the earnings report focused on Amazon’s non-grocery business, the company did note that during the quarter it launched its grocery subscription service, providing unlimited delivery for orders over $35. That includes orders from Whole Foods Market, Amazon Fresh, and other specialty retailers.

“The subscription benefit is available to Prime members in more than 3,500 towns and cities in the U.S., as well as customers using a registered Electronic Benefits Transfer card,” the company noted.

There was no mention in the report about the company’s decision to discontinue using “Just Walk Out” checkout-free technology at most of its brick-and-mortar grocery locations. Amazon spokesperson Jessica Martin said in an email in early April that the company is instead focusing on its AI-powered smart shopping cart technology.

“To deliver even more convenience to our customers, we’re rolling out Amazon Dash Cart, our smart-shopping carts, which allows customers all these benefits including skipping the checkout line,” Martin said.