SymphonyIRI's Times & Trends highlights new developments and critical events across all major CPG categories and channels, providing powerful benchmarking data to help guide your strategic decisions. This issue of Times & Trends explores key trends within the millennial shopper segment that warrant consideration in product development, packaging, marketing and marketing plans. Additionally, the report showcases innovative manufacturer and retailer initiatives that are moving the needle within this critical market segment.

Introduction

The Millennial Generation is also known as Generation Y or The Echo Boom. Though there are some differing opinions around the exact age range defining The Millennial Generation, there is little question that the group is huge and quite unique.

Millennials are entering their adult lives, starting their careers and families during and surrounding The Great Recession—the longest and deepest recession to hit this country since The Great Depression. This is impacting job prospects, wealth and their overall outlook on finances and life. Many millennials are having difficulty making ends meet.

They have turned to cooking to create experiences that they may have paid for in a restaurant in a different economic landscape. They are open to less expensive beauty products and feel that these products can work as well as costlier options. They have adopted a very self-reliant approach to healthcare and are generally trying to eat better to live healthier.

The Millennial Generation is unique from other generations in another way, as well. This is the first generation to be “always connected.”

This generation is the future of the CPG industry. They are forming their day-to-day rituals and associated CPG-related attitudes and behaviors today, and these will likely last a lifetime. To tap into the potential of this market, CPG companies must truly understand what drives loyalty for these shoppers. They must innovate based upon their most pressing needs and wants, and communicate with messages that “hit home” through media that help to define the generation.

Select Findings

- Millennial shoppers, those aged 18-34, are much more likely than the population as a whole to have a “full house.” Despite having larger-than-average households, millennials are only slightly more likely versus the general population to have a $25-$99,000 household income, and they are less likely to have entered the six-figure income ranges. These are just some of the factors that have influencing a more negative and volatile sentiment among millennials versus other age cohorts during the past 18 months.

Click image for larger version

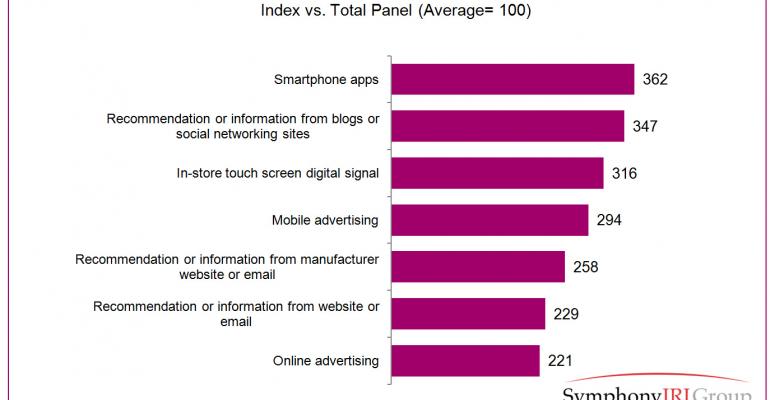

- Millennial shoppers have what it takes to be brand evangelists! SymphonyIRI’s MarketPulse survey series clearly illustrates that millennial shoppers are turning to a range of new media for information and insight when making CPG brand decisions, and they are more than three times more likely than other shoppers to rely on information from blogs and social networking sites. They are also quite likely to share their brand experiences via the Internet and other digital media.

Click image for larger version