SEATTLE — Amazon.com may be gearing up to expand its perishable grocery offering to additional markets, according to some analysts, although the company has yet to disclose any such plans.

Launched six years ago here, AmazonFresh has expanded its reach to about 80 ZIP codes in the Seattle area, but it may be eyeing other markets — including Los Angeles and San Francisco — according to Kate Wendt, a Seattle-based analyst with Wells Fargo Securities.

“Our industry sources suggest they are very close to rolling it out,” she told SN last week.

The company reportedly is adding some refrigerated warehouse space as it expands its distribution infrastructure in states where it has struck new agreements for collecting state sales taxes, including California.

At the Amazon.com annual shareholders’ meeting here last month, Jeff Bezos, chief executive officer, said AmazonFresh has “made progress on the economics over the last year,” according to reports. “They’ve been doing a lot of experiments and trying to get the right mixture of customer experience and economics. I’m optimistic that the team is making good progress.”

Similarly, in a conference call discussing first-quarter earnings, Thomas J. Szkutak, senior vice president and chief financial officer of Amazon, said the company is “very pleased with what we’ve seen in the Seattle area.”

“But again, it’s been a test and we continue to monitor that test carefully,” Szkutak said. “It’s certainly something that we see that customers love the experience. The challenge has always been making sure we can get the economics right, and that’s something we’ll continue to focus on.”

Wendt of Wells Fargo said AmazonFresh doesn’t necessarily have to be profitable for the company to roll it out further.

“Amazon tends to be a loss leader in businesses they are trying to grow,” she said. “They are perfectly happy to operate with a very low operating margin and generate a lot of sales from a lot of customers, so I would not write them off as a grocery competitor.”

Amazon has not released any details about the financial performance of AmazonFresh, and Wendt said she did not have any estimates about sales volumes or number of customers.

The massive e-commerce company — which has long offered some dry grocery products through third-party delivery — launched a limited test of next-day perishables delivery in a few Seattle neighborhoods in 2007. Within about three years, it had expanded its reach to 49 ZIP codes in a 30-mile radius of the city.

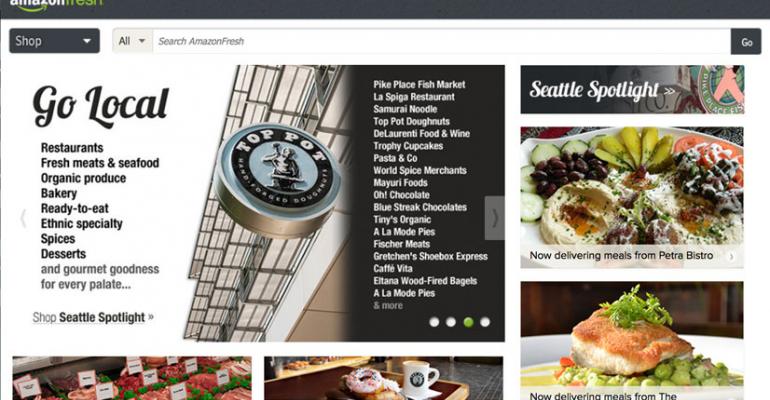

It focuses much of its offering on local product, featuring meat, cheese and seafood from locally known markets and purveyors, as well as prepared foods from restaurants in the area. The site also encourages customers to “Stock Up and Save” with bulk dry grocery, such as eight-packs of paper towels, and to supplement their orders with additional general merchandise items like books, gifts and electronics.

“It enables same day or next day delivery with the rest of their business,” Wendt explained. “That can make it a much more profitable grocery delivery model, if they get the consumer to bundle potential higher margin items into their order.”

In addition to the unique logistics of perishables delivery, one of the other differences between AmazonFresh and the rest of the company’s operations is that its perishables are not priced competitively, Wendt noted.

Low prices, she pointed out, are the company’s “mantra” in its other product categories.

Read more: AmazonFresh Offers iPhone App

“It’s definitely more about convenience,” she said, noting that having high prices — higher than Whole Foods in some cases — “probably limits the addressable audience a little bit.” She noted that prices might come down as the company gains scale with expansion.

Delivery costs $8 to $10, but customers can get free shipping on orders of $50 or more by spending a certain amount to be classified as a “Big Radish.”

Wendt said she thinks AmazonFresh has come a long way and has overcome a lot of the initial obstacles to success.

“When you look back to when they started, they needed to operate their own trucks, they needed to learn how to manage the shrink associated with the perishables business, they needed to secure suppliers, and then perhaps the biggest additional hurdle was that they had to convince consumers that their perishables were good enough to order from Amazon,” she said.

Although Amazon itself doesn’t disclose the sales volumes at its individual businesses, one indication of the popularity of AmazonFresh might be gauged by its followers on Facebook, where as of last week it had just 2,876 “Likes,” vs. New York’s FreshDirect, which had 45,924.

| Suggested Categories | More from Supermarketnews |

|

|

|

|