The traditional axiom that supermarkets are a defensive sector that investors flock to in a weak economy went out the window in 2009.

Shell-shocked stock-market players who pulled their money out in late 2008 in the wake of the real estate and banking implosions seemed to have little appetite for most traditional supermarket shares last year. This was despite the overall recovery of the stock market and some seemingly favorable trends, such as a decline in restaurant spending and an aggressive push of higher-margin private-label items.

Although the SN Composite Index of U.S. and Canadian food retailers, a weighted average compiled by Data Network, Huntington, N.Y., eked out a gain of about 1% for the year, the Dow Jones Industrial Average was up nearly 19%, and the S&P 500 Index rose by about 23.5%.

Fourteen of the 24 food retailers followed by SN — including the three largest traditional operators — saw their stock prices fall in 2009.

Investors seemed to have a contradictory mindset about the sector, as some food retailers that had a poor financial performance, such as Montvale, N.J.-based A&P, were among the best performers in the stock market (up 88%), while Cincinnati-based Kroger Co., a traditional price leader that turned in steady sales growth, saw its stock price fall in double digits.

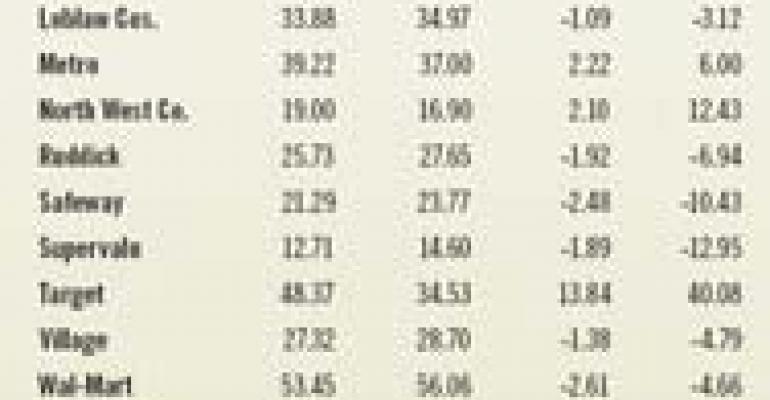

Likewise, Minneapolis-based Target Corp., known as being priced higher than arch rival Wal-Mart Stores, outperformed the Bentonville, Ark.-based discount giant for the year in terms of stock price despite the pressure on consumer spending that accompanied the recession. (Target was up 40%; Wal-Mart fell about 4.7%.)

“Investors seemed to be looking at stocks that were a little more levered toward recovery,” said Karen Short, a New York-based analyst with BMO Capital Markets. “There was outperformance in stocks that were a little more levered to the higher-income sector, which doesn't necessarily make sense, given what consumers were feeling.”

Whole Foods Market, the Austin, Texas-based natural-food specialist, saw its stock price nearly triple in 2009, for example, despite a reputation for being higher-priced overall than its conventional peers and a cutback in discretionary spending by consumers.

The company, whose stock had been among the weakest in the food-retailing sector for the past few years before 2009, was the top gainer among all stocks tracked by SN with an increase of nearly 191%, to close the year out at $27.45, up from $9.44 at the start of 2009.

The company appears poised to have a strong year in 2010, analysts said.

“Strategically, I think they are in a very strong spot,” said Short. “There's not another supermarket company that even comes close to offering what Whole Foods does.”

The company will have to show some acceleration in its sales growth for the stock price to continue moving up, however, she noted.

Andrew Wolf, a Richmond, Va.-based analyst with BB&T Capital Markets, said that after some prudent cost-cutting, Whole Foods was able to adjust its expenses to a more prudent growth pace.

“Now their sales are recovering, and I believe they will probably have positive same-store sales for most of the economic cycle,” he said. “They are not likely going to go back to the roaring days of high single digits, or maybe not even mid-single digits, but I think they will probably be low single digits, depending how things shake out with the economy.”

He said he has a “hold” rating on the stock for now, however, with a positive bias.

Also among the top performers in 2009 was another natural-food specialist, United Natural Foods Inc., Dayville, Conn., which saw its stock rise more than 50%, to close at $26.74 for the year.

Like Whole Foods, UNFI was able to cut costs and adjust to slower sales under the direction of the new chief executive officer, Wolf explained.

“The big story there is the new CEO, Steve Spinner,” Wolf said. “He brought in a lot of cost disciplines and expense controls they hadn't had before.

“Similar to Whole Foods, they very adroitly adapted to a drop in demand and brought down costs rapidly. But at UNFI it was more about new management, and bringing new tools to the table.”

In addition, Wolf noted that the distributor also benefited from a lower cost of fuel.

The strong positioning of United Natural and Whole Foods could portend ongoing growth in the natural-food industry, he projected.

“I think they will both have strong top-line years, and help reestablish natural foods as a growth sector,” Wolf said.

Conventional Retailers Down

Investors were not so interested in traditional supermarket operators Kroger Co., Safeway and Supervalu in 2009, however.

Cincinnati-based Kroger Co., which had been a shining example for the past several years of exactly how supermarkets should be prepared for an economic downturn with its across-the-board reduced pricing and strong value message, saw its stock fall more than 22% during the year, to close at $20.53.

“Kroger's strategy had been to be the relative price leader in the conventional supermarket space, and in 2009 other supermarkets reacted to that, including Safeway and Supervalu,” Wolf explained.

The Southern California market was an example of that. Kroger's Ralphs chain there previously had revamped its pricing to have more of an “everyday fair price position,” but rivals Vons, owned by Pleasanton, Calif.-based Safeway, and Albertsons, owned by Minneapolis-based Supervalu, in 2009 rolled out price-oriented marketing initiatives in that market and others in an effort to retain customers hit by the recession. In the third quarter, Kroger took a non-cash impairment charge of $1.05 billion for the Ralphs division.

“What happened in Southern California encapsulates what happened to Kroger nationally,” Wolf explained. “The other chains said, ‘Hey, we can't just sit here and let our market share walk down the street to Ralphs.’ They said they had to become more relevant on price.”

At the same time, food retailers were facing increasing deflationary trends in a wide range of food items, which put pressure on margins as retailers were forced to keep shelf prices low.

In a report issued late last month, Deborah Weinswig, an analyst at Citigroup, New York, noted that food deflation increased for the fifth consecutive month in November (down 290 basis points, following a decline of 280 basis points in October and 250 basis points in September), and she cautioned that deflation could continue to put pressure on traditional retailers in 2010.

“We continue to be concerned that top-line growth will be pressured at the grocers as a result of the deflationary environment,” she said. “In addition, we expect the supermarkets to face further top-line pressure as competition intensifies in light of price investments by Wal-Mart in 2010.”

In a separate report citing predictions for 2010, Weinswig said she believes food retailers experienced a “modern-day price war” in 2009, and in 2010 an “old-time price war” will break out, led by a sharp reduction in prices on food and other consumables at Wal-Mart to drive traffic.

“We view this move as a game-changer in the food retail industry in 2010,” she wrote. “As a result, there will likely be further price investments from food retailers and gross margin pressure as they scramble to match Wal-Mart's aggressive pricing in 2010.”

Weinswig also predicted that 2010 will be a “breakout year” for private-label growth amid increased efforts by retailers to expand their penetration of these products, which have benefited from the recession.

“We believe that there will be another growth spurt in 2010 for private label and exclusive products as retailers cater to the growing demand for these products and better merchandise these products in-store to appeal to the consumer,” she wrote. “In addition, we believe that retailers are also learning that having control over their own destiny can reap rewards with the branded vendors in terms of lower prices and improved relationships.”

Wolf said he is optimistic that food-retailer stocks can show some improvement in 2010, and he recently upgraded his outlook for Kroger and Safeway, citing the possibility that modest inflation will return and supermarkets will begin to perform better within about six months.

“At that point I think investors will look at the stocks more favorably,” Wolf said. “Investors are saying, ‘When is the worst over?’ I think the worst is already over. I don't think things are going to get worse; I think things are going to get gradually better.”

He said there may not be any evidence that conditions are improving for food retailers in the next few months, however.

Safeway, meanwhile, was down more than 10% for the year, to close at $21.29, and, like Supervalu (down about 13%, to $12.71), seemed to fall in sync with Kroger's surprisingly negative third-quarter report.

Safeway's share-price decline came despite the efforts to improve its price image during the recession.

“They finally have made their pricing more reasonable, so they can be more relevant to consumers in this economy, and can no longer be cast as an overpriced supermarket chain,” Wolf said. “They are saying real sales growth is up, and I think that's the beginning of a recovery. I think they have hit a bottom, and should improve with the industry in 2010.”

Short said she's not so sure Safeway has actually lowered prices that much, however.

“I think they have been smart about communicating that message, but I don't know if they have actually lowered prices as much as they want people to believe they have,” she observed.

She said it may not be the best strategy to emulate Kroger's low-price positioning completely, however, as customers acquired during the recession due to cherry-picking for deals might not be retained.

Weinswig of Citigroup, meanwhile, predicted that 2010 could be the year that Safeway spins off its Blackhawk gift-card subsidiary, which could benefit Safeway's stock performance.

“We believe the recession delayed this event due to a slowdown in discretionary spending and a decline in the valuation of the business,” she wrote. “Steve Burd, chairman, president and CEO of Safeway, continues to reiterate that he will wait for full value. We believe 2010 could be the year that he will have some attractive offers as merger and acquisition and [initial public offering] activity picks up.”

Following are the top five percentage gainers in 2009 among food-retailing stocks tracked by SN:

Whole Foods Market, Austin, Texas, up 190.78%, to $27.45, following a decline of 76.86% in 2008.

The company needs to show acceleration in sales for its stock price to appreciate, said Short of BMO Capital Markets. “I do think growth in the future of Whole Foods is fairly robust,” she said, noting that Whole Foods tempered expectations throughout the year in 2009. “This year investors were underwhelmed by the guidance, and the company made the right call in being conservative.”

After reporting a comp-store sales decline of 2.6% for the fiscal year that ended in September, Whole Foods in November cited an improvement in sales trends and began guiding investors more positively. For fiscal 2010, the company said it expects sales growth of 6% to 8%, comp-store sales gains of 1% to 4% and same-store sales growth between flat and 3%.

A&P, Montvale, N.J., up 88.04%, to $11.79, after a decline of 79.99% in 2008.

“Performance-wise they have not had a good year,” noted Short. “They have a solid investor base, but I'm not sure what the thesis is [for investing in the company.]”

She speculated that investors — Los Angeles-based Yucaipa Cos. in July made a $115 million investment in A&P that boosted its ownership stake to 27.6% — might feel there's an opportunity for the company to be acquired.

“I think ultimately there should be a buyer for A&P, but it's trading richly enough from a valuation perspective as though there already is a buyer,” she said.

Last month another investor — Aletheia Research and Management, Santa Monica, Calif. — said it had acquired a 25% stake in A&P for more than $136.5 million. That followed a second-quarter performance that drove out the company's CEO, Eric Claus, with a comp-store sales decline of 3.8% and an $803 million loss as the company struggled to integrate its Pathmark banner.

United Natural Foods Inc., Dayville, Conn., up 50.06%, to $26.74, after a decline of 43.82% in 2008.

Wolf of BB&T noted that while the integration of the Millbrook Distribution was important, the real driver of United Natural's gains in 2009 was the system of cost controls implemented by Spinner and his management team.

In addition, sales in the natural and organic sector remained fairly robust, he told SN after UNFI's recent first-quarter earnings call.

“Natural and organic didn't get dinged as bad as some other categories during the recession, and that goes back to the natural/organic customer who has stuck to the product,” Wolf said.

-

Target Corp., Minneapolis, up 40.08%, to $48.37, after a decline of 30.94% in 2008.

Weinswig of Citigroup upgraded the stock in October and cited it as one her top picks for 2010. She said she expected the discounter's comp-store sales to be positive for the fourth quarter, noting the positive traffic trends the company reported for September.

“Looking into 2010, a greater focus on food through Target's P-Fresh format, improved inventory levels in apparel, and stronger same-store sales in home due to positive housing turnover, coupled with easy comparisons, should lead to positive same-store sales growth,” she said.

-

Delhaize Group, up 21.80%, to $76.72, after a decline of 27.26% in 2008.

Patrick Roquas, an analyst at Rabobank, Amsterdam, told SN that Delhaize outperformed its peer group of international retailers by 7% in 2009.

“Delhaize reported quite solid U.S. results and improving results for its Belgian operations,” he noted.

Although comps fell 1.3% in the U.S. in the third quarter, the company reported a 10.1% gain in net income for the period. Shortly after that, it unveiled a plan to revamp its pricing and to accelerate the rollout of its Bottom Dollar discount format.

-

Following are the top five percentage decliners in 2009 among food-retailing stocks tracked by SN:

Nash Finch Co., Minneapolis, down 17.38%, to $37.09, after a gain of 27.24% in 2008.

The company appeared to be one of the many industry victims of food-price deflation in 2009.

In reporting results for the third quarter in November, CEO Alec Covington noted that revenues were down more than Nash Finch had anticipated because price deflation had accelerated in the period.

“Instead of deflation beginning to stabilize as we had thought it might, we were wrong and deflation actually had more impact in the third quarter than it did in the second and the first,” he said.

Kroger Co., Cincinnati, down 22.26%, to $20.53, following a decline of 1.12% in 2008.

Short of BMO Capital Markets said Kroger's pursuit of market share by lowering prices might bring customers in the short term, at least.

“Clearly, Kroger made a decision in the back half of 2009 that will pay dividends in 2010, but I'm not sure that is going to help the stock,” she said. “It's not clear their stock has a ton of upside, whereas other companies made the decision to manage gross profit dollars, knowing that the customer is this environment is cherry picking, and it doesn't make sense to cater to that customer.

“Only time will tell what strategy got you the permanent customer. Companies that cut prices to get customers probably didn't gain permanent share.”

Arden Group, Los Angeles, down 24.11%, to $95.62, following a decline of 18.55% in 2008.

The thinly traded stock of the parent company of the 18-unit, upscale Gelson's Markets chain lost most of its value after a weak third quarter that saw sales slide by 9.1%.

“The 9.1% decrease in sales reflects the negative impact of current economic conditions and increased competition in our trade area,” the company said at the time.

This followed with the rollout of aggressive price campaigns in the market by Safeway-owned Vons and Supervalu-owned Albertsons.

-

Winn-Dixie Stores, Jacksonville, Fla., down 37.64%, to $10.04, following a decline of 4.56% in 2008.

Short described Winn-Dixie as a well-run company that has chosen to preserve its margins rather than chase sales with aggressive promotions.

“Winn-Dixie is one of those companies that is not trying to win the cherry-picking customer because it is not sustainable long-term,” she said. “But I think at some point they start to get more promotional. They made the decision to toe the line for a while, but 2010 will be more telling in terms of what they need to do strategy-wise.”

The company posted a loss of $8.1 million for its fiscal first quarter and same-store sales declines of 1.5%, and said it expected difficult times ahead as shoppers continue to curtail spending and with a lack of inflation.

“Given the current state of the economy, we expect that generating significant improvement in sales lift over the next several quarters will be challenging,” said Peter Lynch, president and CEO.

Shortly afterward, a group of investors began agitating for the company to sell itself or buy back shares to increase the stock price, rather than pursue a course centered on remodeling.

-

Spartan Stores, Grand Rapids, Mich., down 38.54%, to $14.29, following a gain of 1.75% in 2008.

Spartan's share price benefited from the profit growth it saw after the 2006 acquisition of the D&W Fresh Market chain, but it has since struggled in one of the country's weakest economic regions.

Last week the company reduced its sales projections for the coming quarters and said it would consolidate its distribution to cut costs (see the related story elsewhere in this issue).

“Spartan is a little bit a victim of its geography,” Short explained. “It is a well-run company, and has been steady in their execution, and aware of what they need to do to protect their profits.”

She noted that the investor base that piled into the stock following the D&W acquisition based strictly on certain metrics the company generated has since left.

“You can say a victim of computerization more than anything.”