AUGUST 2009

EXECUTIVE OVERVIEW

IRI's Times & Trends highlights new developments and critical events across all major CPG categories and channels, providing powerful benchmarking data to help guide your strategic decisions. This issue of Times & Trends provides insights into recession-driven changes in consumer shopping patterns across departments, categories and consumer segments, and serves as a foundation for competitive and distribution strategy development as well as a baseline for ongoing tracking efforts.

Introduction

U.S. consumers have been battling adverse economic conditions for well over 18 months now. The country has faced sky-rocketing gas prices, high levels of unemployment, unprecedented increases in CPG prices and an array of other financial stressors.

To cope, consumers have been forced to make significant changes to everyday behaviors. No doubt, today’s consumers are more self-reliant and more in-tune with how and where money is spent.

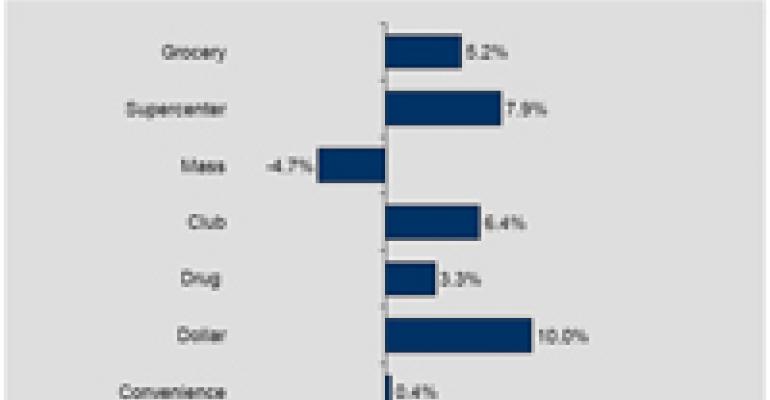

In last year’s Channel Migration issue of Times & Trends we highlighted sizable share gains by supercenters across departments and income segments resulting from consumer efforts to stretch their CPG dollars. Supercenters continue to play a major role in providing consumers with affordable CPG solutions.

Over the past year, however, competing retail channels have turned up the heat.

The end result is a more complex battleground. Retailers are embracing specialized and targeted marketing and merchandising strategies in an effort to win shoppers.

This report provides insights into recession-driven changes in consumer shopping patterns across departments, categories and consumer segments, and serves as a foundation for competitive and distribution strategy development as well as a baseline for ongoing tracking efforts.

Select Findings

Increasing trip frequency is offering CPG marketers more opportunities to connect with shoppers through innovative in-store promotional campaigns. However, plan-ahead shopping has also become a common money-saving strategy, with shoppers predicting that 76% of their 2009 purchase decisions will be made before they get to the store. Supporting in-store efforts with feature ads and other traditional media support is absolutely critical.

|

| Select chart to enlarge. |

While supercenters continue to gain share across departments, other channels are also demonstrating gains in select departments. For example, the drug channel continues to make strides in healthcare and beauty/personal care departments, outperforming all channels, and even outpacing gains made by supercenters. Grocers have also gained share in healthcare and the channel is performing particularly well in the general merchandise department.

|

| Select chart to enlarge. |

See the complete report in the "Channel Migration: The Blurring of Shopper Loyalty" pdf.