SymphonyIRI's Times & Trends highlights new developments and critical events across all major CPG categories and channels, providing powerful benchmarking data to help guide your strategic decisions. This report explores current and emerging trends around private label, as well as national brand efforts to protect and grow their position in the CPG marketplace.

Introduction

Private label products are viewed as differentiators. They are no longer simply “me too” products that offer “the same thing for less money.” More and more, they bring something new to the market. Private label products are strategic weapons. Increasingly, they are tools that separate a retailer from its competitors, hopefully in a way that helps to build loyalty and purchase behavior. They also offer better margins, thereby supporting bottom line growth—a critical role to be played in an industry that has forever been marked by thin margins and today is feeling margins seemingly choked out of existence.

For consumers, private label offers money-saving opportunities. Private label also offers value. New products, new attributes, new sizes… private label products are opening doors to attributes which have historically been out of the reach of many consumers by bringing them into an affordable price range.

And still, private label can be—should be—even more. Correctly orchestrated, private label architecture can give retailers significant leverage with suppliers. It can also help to increase customer loyalty. And it can help retailers to develop product assortments to address niche-market needs—once again building and broadening customer loyalty.

Much opportunity remains for private label marketers and national brand marketers alike. Meanwhile, national brand marketers must continue to identify and capitalize on opportunities to raise their own value proposition. But, success will be achieved by those who are thinking outside the box.

Select Findings

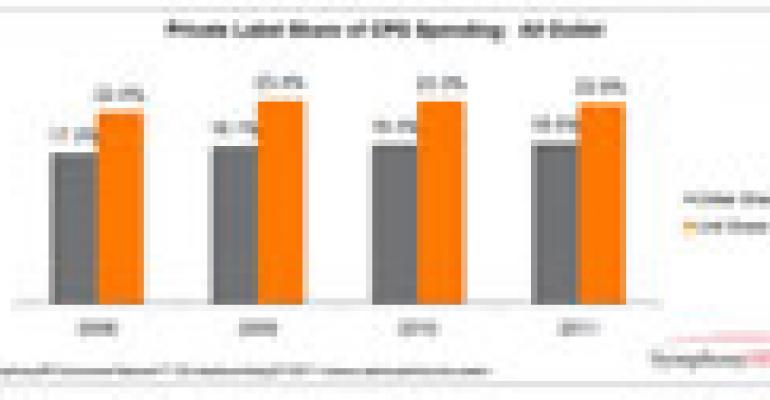

Private label share of CPG unit sales dipped during the past year, the first decline since the beginning of the economic downturn. Dollar share rose slightly, influenced by private label price increases that were sharper versus industry average. Within the CPG industry, private label currently accounts for 22.9% of units and 18.5% of dollar sales.

While private label continues to offer considerable savings versus nationally branded products, the gap is shrinking across most CPG departments. On average, private label price per volume increased 5.3% during the past year, versus a total industry average of 1.9%, driving the average private label price discount down more than two points, to 29%. In some categories, though, private label prices are rising much more sharply, and the savings gap is closing more rapidly.