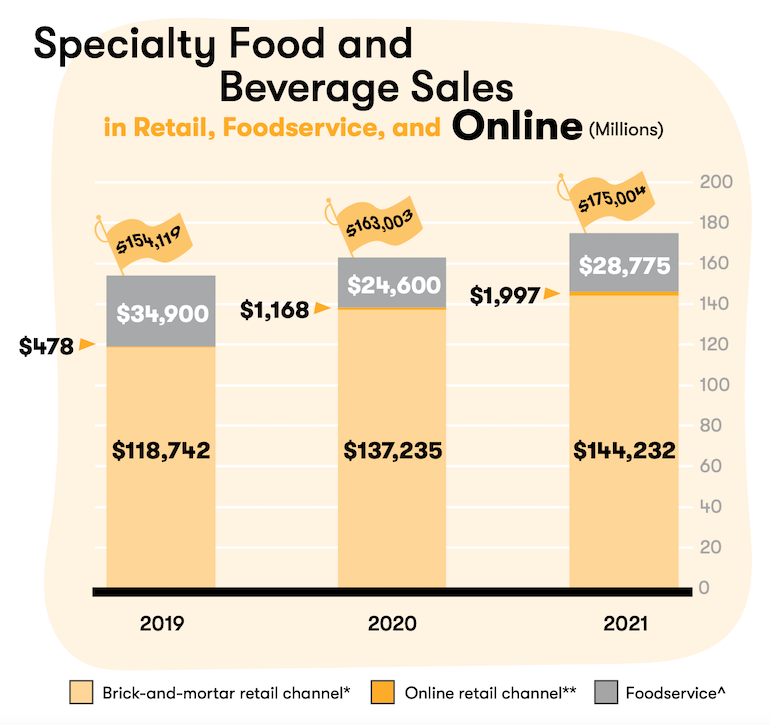

The U.S. specialty food market hit a whopping $175 billion in sales in 2021, climbing 7.4% from a year ago, according to the Specialty Food Association.

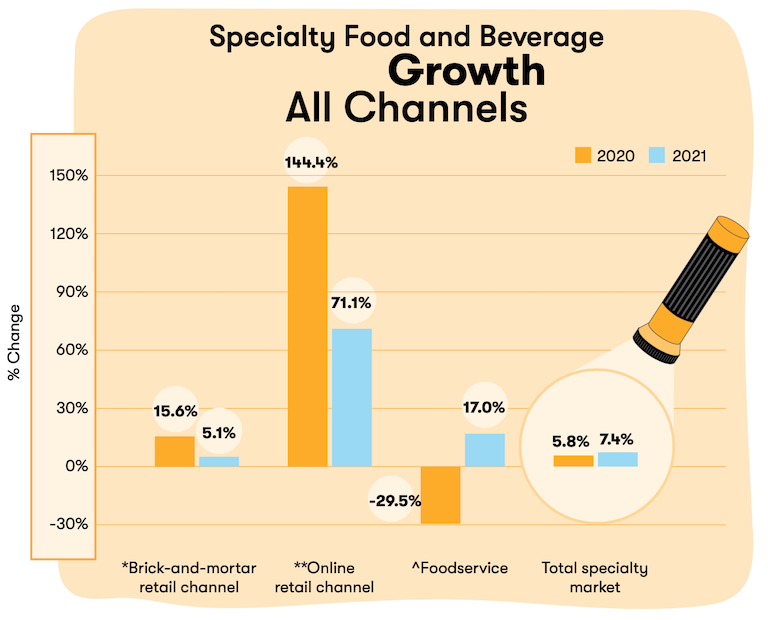

That growth compared with a 5.8% increase the year before, when foodservice’s steep decline offset outsized gains in brick-and-mortar retail and e-commerce, the association said in its 2022 State of the Specialty Food Industry Report, release yesterday.

Frozen and refrigerated meat, poultry and seafood led the specialty food categories in retail dollar sales in 2021, followed by cheese and plant-based cheese in second place, and chips, pretzels and other snacks in third. Three refrigerated categories topped the fastest-growing group: ready-to-drink (RTD) tea and coffee at No. 1, followed by creams and creamers and then entrees.

“The specialty food market has prospered amid two difficult years, with our latest research showing specialty continues to grow at a faster rate than all food,” Denise Purcell, vice president of content and education at the Specialty Food Association (SFA), said in a statement. “Growth will continue, but at a slower pace than the industry experienced during the 2020 pandemic-influenced whirlwind of grocery shopping and at-home meal preparation, and will depend on supply chain bandwidth and shifts in challenges like inflation, shipping issues, cost increases and materials shortages.”

Manufacturers continue to report they are unable to properly forecast sales because they often don't know what their supplier shipments will look like, according to SFA’s State of the Specialty Food Industry Report. Lead times for shipments fluctuate, too, causing production schedule delays. These factors influence how makers formulate their products, as they evaluate which SKUs they can confidently produce, made with ingredients they can reliably source and priced properly to achieve profit despite increased raw material costs, the report said.

After trailing in 2020, specialty beverages jumped past food and grew twice as fast in 2021. SFA said consumers see certain products as critical, and others as discretionary. For example, food was more of a consumer priority during the initial phases of COVID-19 but, over time, consumers expanded their shopping lists to include more specialty beverage purchases. RTD alcoholic beverages like hard seltzer, hard kombucha and fermented functional cocktails are growing rapidly.

The overall plant-based specialty retail market grew 6%, exceeding $7.7 billion in 2021 after 26% growth in 2020, according to the SFA report. Plant-based growth has outpaced the entire specialty retail market, which expanded 4% in 2021 and 20% in 2020. However, some plant-based categories grew specialty sales slower than the entire market in 2021, including yogurt and plant-based yogurt; tofu; creams and creamers (shelf stable); plant-based milk (refrigerated); and plant-based milk (shelf stable). The largest growth gap is with refrigerated plant-based meat alternatives, which grew 34% in specialty but 66% in the total market.

The top special food categories in retail dollar sales for 2021 were meat, poultry, seafood (frozen, refrigerated); cheese and plant-based cheese; chips, pretzels, snacks; bread and baked goods; and coffee and hot cocoa (non-RTD). Rounding out the top 10 by sales were refrigerated entrees; chocolate and other confectionery; bottle water; frozen desserts; and frozen lunch and dinner entrees.

In terms of the fast-growing segments, SFA said the top 10 categories were RTD tea and coffee (refrigerated); creams and creamers (refrigerated); entrees (refrigerated); frozen breakfast foods; frozen appetizers and snacks; seasonings; pasta (refrigerated), frozen fruit and vegetables; sauce, pasta, and pizza (shelf stable); and soda and carbonated beverages.

The SFA noted that, this year, the report took a closer look at specialty perishable sales, which are expected to reach nearly $33.5 billion in 2022. Perishables are critical to specialty, both in scale and as a good source of growth, the association said. After being challenged by shutdowns during COVID, perishables can expand to better meet consumers’ needs for hot, ready-to-eat or take-home, heat-and-eat fresh meals; meal kits; sandwiches, side dishes and salads; breakfast foods; confections and desserts; and hot and cold beverages.

Also, consumers want more BIPOC- and women-owned brands, according to the SFA report, and retail buyers and foodservice operators are looking for incubators, brokers, wholesalers and distributors, and sales consultancies that specialize in supporting and growing these brands. Showcasing such brands has moved far beyond seasonal features to align with observed months like Black History or Women’s History, SFA observed. The association added that the pandemic also gave retailers more insight into which store formats shoppers want next, and smaller footprints with minimal human contact are in demand.