While the COVID-19 pandemic has drastically impacted America's grocery-shopping patterns, consumers continue to care deeply about transparency — and favor food brands and retailers that share information readily. But as new research by FMI–The Food Industry Association and NielsenIQ reveals, shopper perspectives on transparency have evolved, running much deeper and broader than just a few years ago.

According to the "Transparency in an Evolving Omnichannel World" report, which presents survey data from 1,035 U.S. adults who grocery shop for their households, today's consumers want food brands and retailers to share more than just ingredient lists and Nutrition Facts. They also seek information about manufacturing practices, ingredient sourcing, company sustainability efforts and more. Full disclosure of such details, most shoppers believe, is a key indicator of transparency, which is critical to earning their trust and loyalty.

Notably, the survey respondents were not necessarily natural products shoppers, who are known for placing high value on manufacturer and retailer transparency. However, the fact that the average U.S. consumer now feels so strongly about transparency means that natural brands and retailers must continue to share their stories and detail their product attributes — and do so across multiple channels.

“The data from this report strongly reinforce the old adage that honesty is the best policy,” said Steve Markenson, director of research and insights for FMI. “Consumers want to know where their food comes from and how it gets made and that has held true even as the pandemic has changed grocery shopping habits. Whether online or in store, shoppers prefer brands that tell the whole story about their products.”

Omnichannel is the new way

As has been widely reported, the pandemic has accelerated grocery e-commerce by at least five years. According to the FMI and Nielsen survey, 55% of consumers today have purchased groceries online in the last 30 days, compared to just 26% in 2018. Among those who currently buy groceries online, 64% didn't start doing so until early 2020, with 43% specifying the pandemic as the reason for their switch.

But shoppers aren't abandoning brick-and-mortar. Despite the sharp uptick in e-commerce, 45% of respondents said they make just as many in-person visits to the grocery store today as they did before the pandemic began. Another 44% said they do more brick-and-mortar grocery shops now than pre-pandemic. This could imply that, with the pandemic prompting people to eat more healthfully and cook more at home, more consumers are grocery shopping these days (or shopping more frequently), whether in-store, online or, most likely, a mix of both.

Regardless, with food-buying becoming decidedly omnichannel, it behooves brands and retailers alike to deliver on consumer demands both in-store and online, particularly when it comes to transparency.

What shoppers want to know

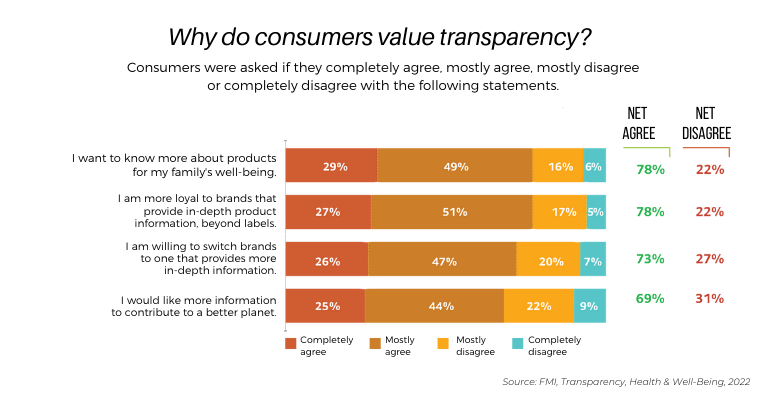

The FMI and NielsenIQ survey defined transparency for respondents as "providing detailed information such what is in your food and how it was made." When asked how much transparency matters to them, 72% of shoppers said it was either important or extremely important when deciding which food brands and retailers to support. For 78% of those consumers, their desire to be informed is tied to their families' health and well-being, while 69% said it's linked to environmental concerns.

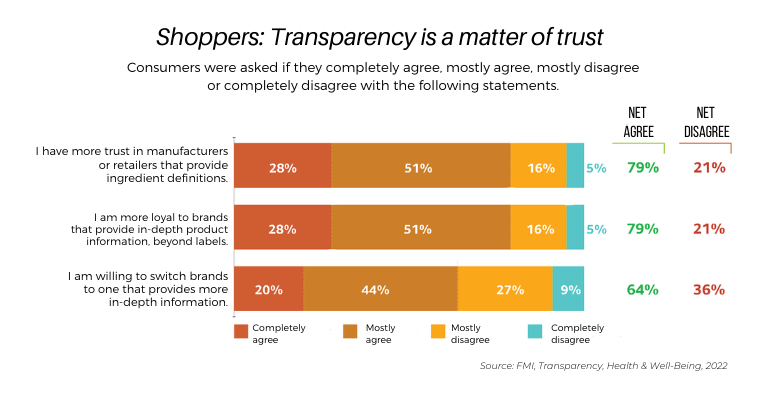

The survey also shows that transparency typically translates to trust, which in turn breeds loyalty. A whopping 79% of respondents reported that when manufacturers and retailers share complete and easy-to-understand ingredient definitions, they are more likely to trust those companies. Similarly, 79% said they are typically more loyal to brands that offer more in-depth information than what's on the physical product packaging. In fact, 64% would switch from a brand they normally buy to a different one that shares such details.

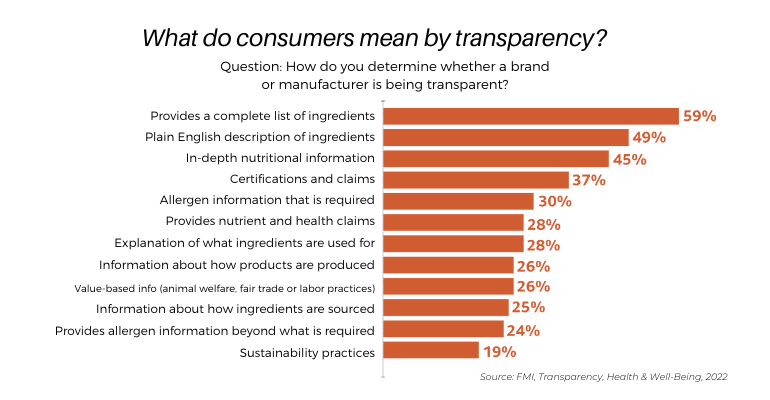

As for what kinds of information indicate to consumers that a company is being transparent, 85% of respondents mentioned the availability of ingredient information. Within that, the most important assets for shoppers to see are a complete list of ingredients, easy-to-understand ingredient descriptions and explanations of how ingredients function within a product. Additionally, almost half of all respondents cited nutritional information as a conveyor of transparency.

But for the majority of consumers today, transparency means more than just disclosing ingredient or nutritional information. Eighty percent listed at least one secondary indicator of transparency, a marked increase from past survey results, suggesting shoppers' progressing perspectives: 42% of shoppers view disclosure of allergen information as a sign of transparency; and 37% look to third-party certifications such as USDA Organic.

Many consumers also consider information about how products are made, where ingredients come from and whether a product is compatible with a specific diet. Shoppers today also care more about how companies embody environmental and social responsibility and consider those essential parts of the transparency equation.

The vast majority of shoppers (79%) are at least somewhat interested in looking beyond product labels to find these types of information, with half saying they are either very or extremely interested. By and large, shoppers like having the option to access this information online, with 77% saying they are at least somewhat likely to look for it this way, 32% of whom said they are very likely.

As for what those shoppers most want to learn online, the top requests include ingredient definitions and sourcing, nutritional information, country of origin and details on manufacturing processes. This underscores the need for natural brands and retailers to ensure their digital channels contain in-depth product descriptions, company mission statements and other details.

"Transparency trends continue to evolve as omnichannel gains importance," said Sherry Frey, vice president of total wellness with NielsenIQ. "As consumer demand great transparency, brands have an opportunity to educate consumers, communicate sustainability and health credentials and win consumer loyalty."

This article originally appeared on New Hope Network, a Supermarket News sister website.