Amid high inflation fueled by COVID supply-chain reverberations, and now the war in Ukraine, grocery prices experienced their biggest year-over-year increase in more than 40 years in February.

The Consumer Price Index (for all urban consumers) rose 7.9% year-over-year (unadjusted) for February, the largest since the period ended in January 1982, the U.S. Bureau of Labor Statistics (BLS) reported Thursday. The 0.8% month-to-month increase (seasonally adjusted) eclipsed the 0.6% uptick from December to January and more than doubled the 0.4% monthly increase in February 2021.

Food pricing surged 7.9% year over year in February, with the monthly uptick of 1% slightly higher than the 0.9% increase in January but double the 0.5% gain in December.

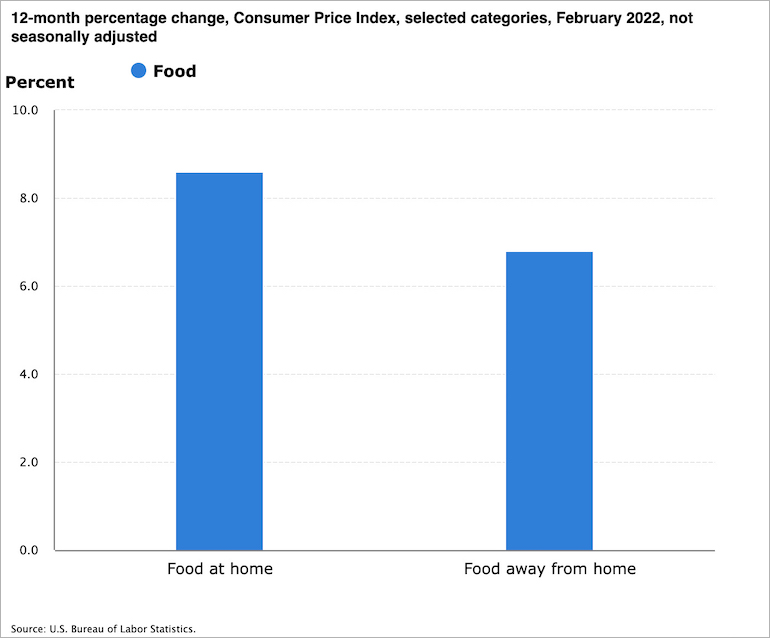

Food-at-home prices in February jumped 8.6% year over year — the largest 12-month increase since the period ended in April 1981, BLS noted. Monthly gains in the food-at-home index have been sharp so far in 2022, up 1.4% in February and 1% in January after only a 0.4% uptick in December.

In comparison, the food-away-from-home index saw a sequential decrease in February — up 0.4% after increases of 0.7% in January and 0.6% in December — yet remained elevated year over year, up 6.8%.

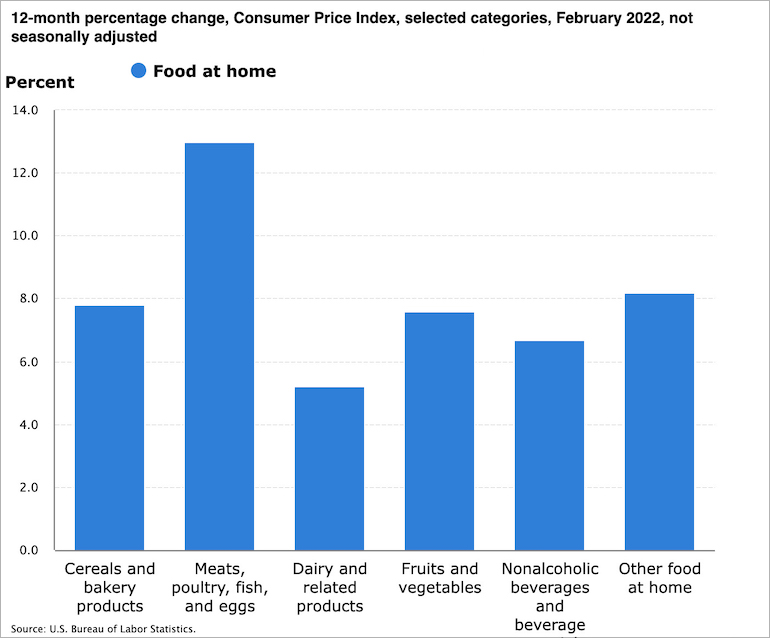

For food-at-home, all six major grocery store food group indices rose in February. On a year-over-year basis, the index for beef climbed 16.2%, while the index for meat, poultry, fish and eggs increased 13%. Upticks in the remaining groups included 7.8% for cereals and bakery products, 7.6% for fruit and vegetables, 5.2% for dairy and related products, 6.7% for non-alcoholic beverages and 8.2% for other food at home.

Month to month, the index for fruits and vegetables went up 2.3% in February, its largest monthly gain since March 2010, according to BLS. That includes increases of 3.7% for fresh fruit and 1.3% for fresh vegetables. BLS said the index for dairy and related products rose 1.9%, its biggest monthly uptick since April 2011. Monthly price hikes in February for the other food groups included 1.6% for non-alcoholic beverages; 1.2% for meat, poultry, fish and eggs; 1.1% for cereals and baked goods; and 0.8% for other food-at-home.

Skyrocketing energy costs were the chief driver of February’s CPI surge, up 25.6% year over year and 3.5% month to month. Gas and fuel oil prices jumped 38% and 43.6%, respectively, versus a year ago. The monthly increases were 6.6% for gas and 7.7% for fuel oil.

Excluding food and energy, February’s CPI was up 6.4% from a year ago and 0.5% month to month, BLS reported.

“The inflation situation is getting worse, not better. Household staples are becoming more and more expensive, crowding out spending on discretionary categories and delaying the spending reallocation back to services. And while gas prices explain much of the story, food and housing prices were also key drivers in February,” John Leer, chief economist at data intelligence firm Morning Consult, said in a statement.

“Unfortunately the war in Ukraine will make it more difficult to get inflation under control. Gas and energy prices continue to rise, wheat prices are through the roof and supply chains remain in chaos,” Leer explained. “For the first time during this recovery, we need to take seriously the risk of stagnating growth paired with inflation, so-called stagflation.”

In its March 2022 U.S. Economic Outlook, Washington, D.C.-based Morning Consult noted that American consumers already have been grappling with the pricing impact of supply chain disruptions, especially in food and groceries. Fifty-one percent of U.S. adults encountered limited grocery supply in February, up from 47% in January, the report said. In turn, supply chain snags and inflation have consumers more worried about being able to afford their groceries, with 13.2% of U.S. adults in January saying they’re not confident they can pay for their monthly grocery bill, up from 8.2% in December.

Russia’s ongoing attack on Ukraine also will reverberate in global commodity markets and affect pricing, according to Morning Consult.

“While the United States does not directly rely on Russia or Ukraine for its food production, Ukraine is a significant producer of wheat, most of which is purchased by Europe,” the March Outlook report said. “Russia’s invasion will limit Ukraine’s wheat production, driving down the supply and increasing the price. Wheat markets are global markets, and these developments in Europe are likely to have some adverse affect on U.S. consumers.”

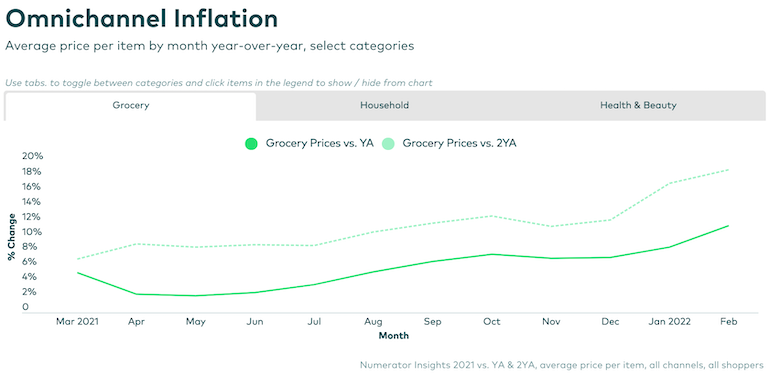

The February Price Pulse tracker of consumer data specialist Numerator showed that shoppers are paying more for everyday goods across categories. In grocery, prices climbed 11.5% year over year for February, up from the tracker’s previous high of 8.7% in January.

Household products, however, have experienced the sharpest price hikes, Chicago-based Numerator noted. In February, pricing for household items was 15.3% higher than year ago and up 24% over two years. Health and beauty care prices also edged up during the 2021 the second half but have since decelerated in 2022. Despite rising 11.2% in February, health and beauty was the only category with slower growth in February than in January versus a year ago, according to the Price Pulse tracker, which is based verified purchase data from over 100,000 Numerator panelists.

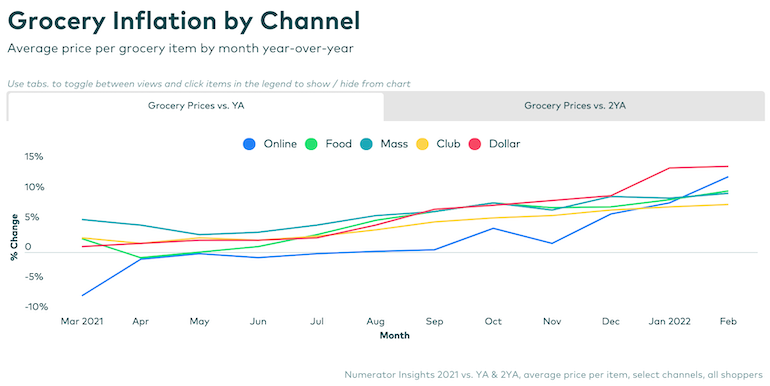

By retail channel, dollar stores exhibited the steepest rise in grocery prices, up 14.3% year over year in February (+22.5% over two years). The next largest grocery price hikes for the month were seen by online retailers at 12.6% (+6.5% two years), supermarkets at 10.3% (+14.7% two years), mass merchants at 9.8% (+15.8% two years) and warehouse clubs at 8% (+11.8% two years).

The effects are mostly being felt by lower-income shoppers. “Low-income consumers are paying 12.8% more for groceries than a year ago, compared to middle-income (+11.4%) and high-income (+11.1%) consumers,” Numerator reported.