In response to the spread of novel coronavirus (COVID-19) — today officially declared a pandemic by the World Health Organization (WHO) — consumers are changing their shopping behavior in ways that could shape future buying patterns, new research from Nielsen finds.

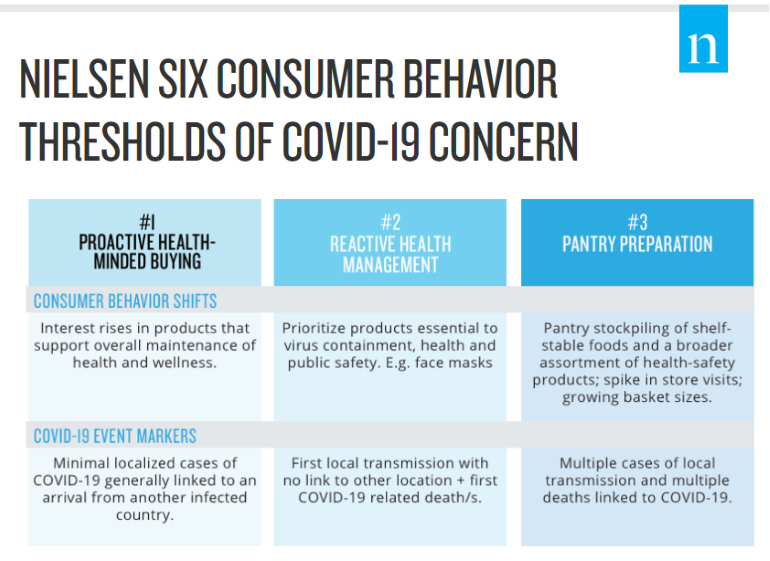

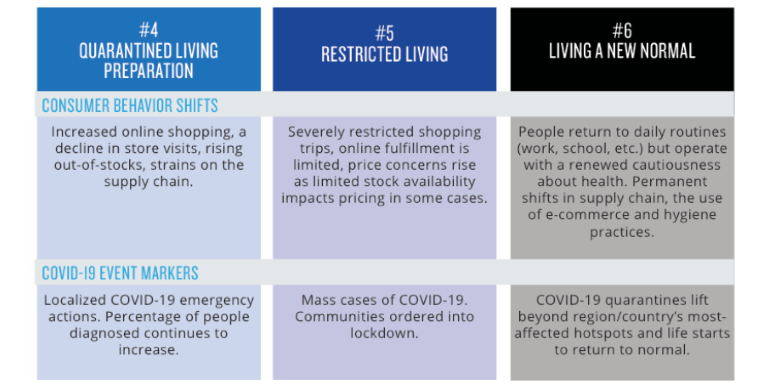

These consumer behaviors encompass six “thresholds” as shoppers react to the advance of coronavirus worldwide and how incidence of the virus approaches their communities and begins to affect the way they live, Nielsen said in an analysis released yesterday. The thresholds give early signals of spending trends for health supplies and emergency pantry items as well as changes in the way consumers are making purchases, the researcher noted. (Chart graphics courtesy of Nielsen)

What’s more, the behaviors are being “mirrored” across multiple global markets and are linked to news cycles charting the COVID-19’s advance.

“The outbreak has already caused an array of changes in shopping behavior, and we’re focused on understanding the ones that will come next, how long they’ll last and whether any will stay with us after the outbreak is behind us,” Scott McKenzie, Nielsen global intelligence leader, said in a statement.

At the first threshold stage, consumers engage in proactive health-minded buying, showing increased interest in products supporting maintenance of health and wellness. This comes with news of local COVID-19 cases tied to people arriving from an infected country, according to Nielsen.

Next, as the first reports of “community spread” and local COVID-related deaths emerge, shoppers shift to the second stage: reactive health management, in which they focus on purchases to prevent catching the virus and spreading to others, such as face masks, hand sanitizers and disinfectant products.

For the week ending Feb. 29, Nielsen reported, year-over-year dollar sales at all U.S. outlets jumped 313.4% for hand sanitizers, 475% for household maintenance masks, 114.5% for medical masks, 80.4% for thermometers, 99.6% for aerosol disinfectants, 59.6% for bath and shower wipes, 52.3% for first aid kits and 14.7% for supplements.

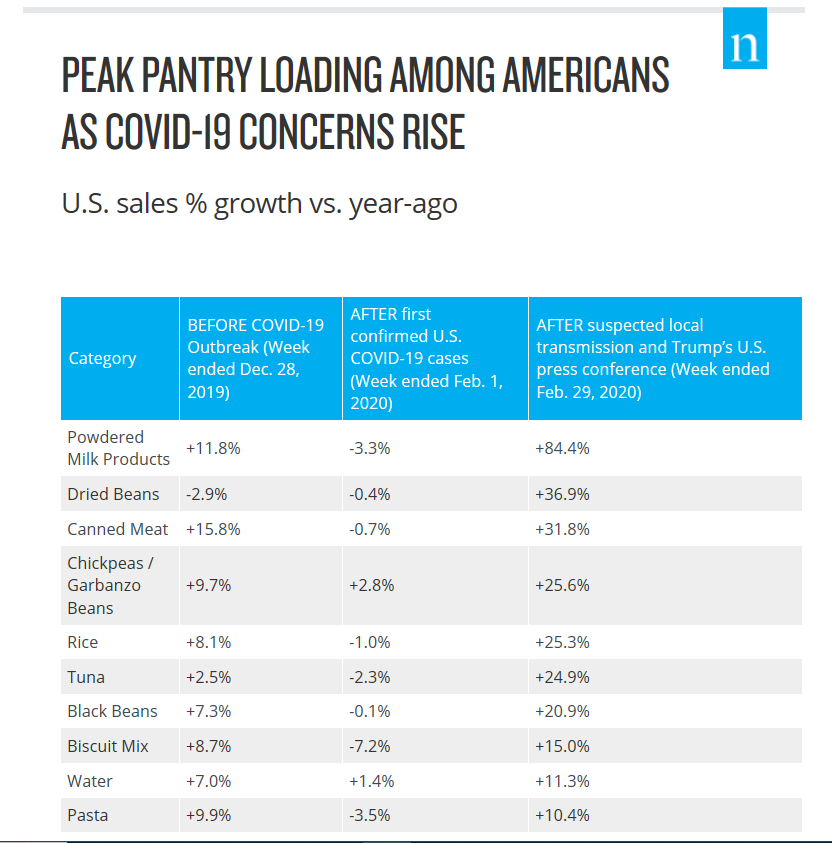

Mounting cases of local coronavirus transmission and related deaths then push consumers to the third stage of pantry preparations. That entails stock-ups of shelf-stable foods and a wider array of health safety products, plus more shopping trips with larger basket sizes to procure these items, Nielsen explained.

For example, in food and beverages, U.S. dollar sales for the week ended Feb. 29 climbed 322.5% for oat milk, 36.9% for dried beans, 31.8% for canned meat, 158.3% for fresh meat alternatives, 84.4% for powdered milk products, 25.3% for rice, 24.9% for tuna, 11.3% for water and 10.4% for pasta.

Dollar sales gains in health-related categories included medical supplies (+85.3%), rubbing alcohol (+65.5%), hydrogen peroxide (+32.2%), multi-purpose cleaners (+29.8%), antiseptic (+24.1%), cold/flu remedies (+18.1%), cough remedies (+16.9%) and antibiotics (+15.4%).

“The world is largely past the first stage of proactive health-minded buying that drove only minor changes to sales patterns. However, at threshold level two (reactive health management), consumers in affected markets began stocking up on essential health-safety products, such as hand sanitizers and masks,” Nielsen stated in the report. “But as news reports detailed the continued and quick spread of the virus around the world, consumers in many countries jumped to threshold level three: pantry preparations. By this stage, they begin developing stockpiles of food and emergency supplies. These spending spikes lessened in the weeks after the panicked moments but spiked on subsequent news events or developments.”

Threshold four, Nielsen said, begins efforts by consumers to get ahead of “panicked purchasing.” The fourth stage — triggered by a rising percentages of confirmed COVID-19 cases and local emergency actions — is marked by fewer store visits and increased online shopping. Meanwhile, retailers encounter higher out-of-stocks and strained supply chains.

“Threshold levels one to four are beginning to show predictable signs of spending from consumers,” according to Nielsen. “Depending on what stage any particular country is in, there are signs that spending behaves in a common way that may make it possible to understand what might happen next, country to country.”

Nations with mass cases of coronavirus and locked-down communities or regions, including China and Italy, have reached the fifth threshold of restricted living, Nielsen said. At that stage, consumers severely curtail shopping trips, online fulfillment is limited and pricing concerns grow as stocks of in-demand products become limited.

Light begins to appear at the end of the tunnel at threshold six, dubbed “living a new normal.” Here, people return to their daily routines at work, school and elsewhere yet hold a “renewed cautiousness about health,” reported Nielsen. Similarly, there are permanent shifts in the supply chain, e-commerce use and hygiene practices.

“Some markets, such as Italy and South Korea, are well past the early thresholds of proactive health-minded buying, reactive health management and even pantry preparations. This week, Italy was put into a countrywide lockdown,” Nielsen said in the report. “As it stands, China is the only country with large levels of its population impacted to reach level six and begin returning to normal ways of living. After extended periods of isolation, many workers have returned to offices and factories, with the exception of areas hardest hit, such as Hubei province.”

Nielsen pointed out that the six thresholds offer indicators for consumer packaged goods (CPG) manufacturers and retailers grappling with supply issues in trying to meet spikes in demand amid changing shopper purchasing behavior.

“We’re already seeing additional markets enter the threshold of ‘restricted living.’ As patterns begin to emerge in response to news events of this nature, it will be imperative for companies to learn from these scenarios so they can sustain growth even in times where COVID-19 has uprooted people’s lives,” McKenzie added. “These patterns will help provide leading and trailing indicators to those trying to understand how people will respond as developments continue to play out at different times in different countries.”

In the United States, the Centers for Disease Control and Prevention (CDC) reported 938 cases of COVID-19 (confirmed and presumptive positive) and 29 deaths as of March 11, including 38 states and the District of Columbia.

Globally, the total number of coronavirus cases has exceeded 118,000 cases as the disease has spread to 114 countries, killing 4,292 people as of March 11, according to WHO. China accounts for about 68% of worldwide COVID-19 cases (approximately 81,000), followed by Italy at about 10,100 cases, Iran at over 8,000 cases and South Korea at nearly 7,760 cases. In Europe, France has reported almost 1,800 cases of coronavirus, with Spain (1,600-plus cases) and Germany (nearly 1,300 cases) also surpassing the 1,000 mark.

*Follow Supermarket News' coronavirus coverage at our dedicated new page.