The role of coupons is getting bigger in the consumer products industry as manufacturers increasingly rely on them to encourage brand interaction, according to a new SN survey.

More than one-quarter (29%) of manufacturer respondents said they're focusing more on coupon promotions now than in the past, show the findings of the 2009 Survey of Manufacturer and Retailer Promotional Practices, an online poll conducted in June.

“We have a lot more coupon-driven programs,” said one manufacturer participant.

The survey is based on 211 responses, including 55 manufacturers and 56 retailers. The remainder are consultants, wholesalers and sales agencies.

While couponing is especially appealing to the industry in light of the current economic conditions, there are plenty of other reasons why manufacturers are getting more involved with the promotional tool.

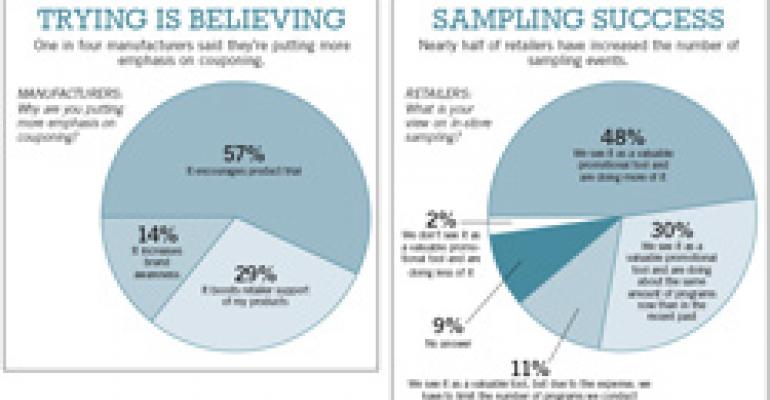

When asked why they're putting more emphasis on couponing, more than half (57%) of manufacturer respondents said it was to encourage product trial; 29% to boost retailer support of their products; and 14% to increase brand awareness.

One-quarter of suppliers are using more targeted forms of coupon distribution. These include using loyalty card data or other information to provide personalized coupons either in-store, by direct mail or in another way (21%); using retail loyalty data to target specific offers to specific consumers (21%); handing out coupons at targeted events, such as festivals (7%); and linking Internet coupons directly to loyalty cards (7%).

Consumer goods firms relied most heavily this year on traditional coupon tools like freestanding inserts (36%) and circular ads (33%). But an increasing number are experimenting with newer techniques like digital coupons, which 3.6% of respondents said they used last year, 5.5% said they're using this year and 7.3% said they plan to use in 2010.

Indeed, a growing number of manufacturers have partnered with various digital-coupon providers to provide savings that can be downloaded from the Internet or computer directly to supermarket loyalty cards.

General Mills, Kimberly-Clark and others are even part of Safeway's new “CouponLink” program, a special area of the Safeway website that provides several different digital coupon options, including those from Shortcuts.com, Cellfire and Procter & Gamble's P&G eSaver, which offers a variety of P&G digital coupons.

Coupons can be organized by category or product name, linked to the Safeway Club Card and automatically redeemed at checkout.

After testing digital coupons at Tom Thumb and Randalls, Safeway recently rolled them out to all of its stores, including Vons, Pavilions, Tom Thumb, Randalls, Genuardi's, Carrs and Dominick's.

MOBILE MARKETING

A specific type of digital coupon — the mobile phone coupon — is also gaining steam: 2% of respondents to SN's survey said they're using them.

Safeway's Cellfire and Shortcuts.com offers, for instance, can be downloaded via mobile phone or smart phone, even while the customer is in the store.

Unilever is in the midst of a mobile coupon pilot with the ShopRite store in Hillsborough, N.J. Coupons for Ragu pasta sauce, Dove body wash, Hellmann's mayonnaise, Lipton iced tea and Breyers ice cream can be redeemed simply by holding up a cell phone at checkout. Mobile marketing firm Samplesaint, Chicago, is the company behind the technology.

What makes the test unique is that no loyalty card is necessary. After coupons are selected, users receive a text message with a link that takes them directly to their offers. They then redeem the coupons at checkout by having the cashier scan the barcode on the coupon image that appears on their phone's screen. The coupons are credited the same way as paper coupons.

ShopRite shoppers can also access the coupons directly in-store by text messaging a number found on shelf talkers under each participating item. Once the text message is sent, the mobile phone user immediately gets a text in return with a link to Samplesaint's secure mobile site, where they can view and select offers.

Along with coupons, marketers are promoting their brands in other ways. SN's research shows continued focus on the store as a marketing medium. Nearly three-quarters (73%) of manufacturers said they're more involved with account-specific promotions.

“We're doing more account-specific, unique spending,” said one manufacturer.

The value of in-store marketing is evident in other responses. More than half (58%) of respondents said they're using in-store sampling this year. This compares to 22% who said that they're conducting event sampling and 15% who said they're relying on Internet sampling.

Such efforts could be seen as an alternative to expensive promotions involving loyalty card data. More than one-third (35%) of respondents said the biggest hurdle to using the data is the amount that retailers charge for it.

But the tide may begin to turn, as larger retailers become more generous with sharing sales data at no cost.

A recent Grocery Manufacturers Association, Washington, report found that most U.S. grocery retailers and mass merchandisers with more than $5 billion in annual sales are sharing weekly store sales data and other information, like loyalty card data, with their suppliers for free.

“Data this current and available from this many retailers at this frequency have never before been available to CPG manufacturers,” according to the white paper, “Retailer-Direct Data Report.”

WHAT RETAILERS SAID

As important as in-store promotions are for manufacturers, they're also a key strategy for retailers.

Nearly half (48%) of retailer respondents said sampling is a valuable promotional tool and they are doing more of it.

The expense is a factor, though. Eleven percent said that while in-store sampling is effective, due to the expense, they've limited the number of programs they conduct.

When it comes to in-store media, displays are the preferred tool, as more than half (57%) of retailers said they are requesting more displays from manufacturers.

Displays, many said in write-in responses, enhance the shopping experience by encouraging brand interaction. As part of the industry's movement to shopper marketing, they are being used as a silent, but persuasive salesman, many noted.

“Displays get the consumer engaged,” said one retailer respondent. “Displays bring the consumer's eye right to the product,” said another.

These presentations also help enhance price perception.

“Value-priced displays are very impactful to customers,” said a retailer participant. “Customers perceive lowering pricing throughout the store.”

“Displays, especially in-aisle, have a physical presence that is difficult to ignore,” said another.

At-shelf signs are another popular in-store promotional tool that 41% of retailers are requesting more from suppliers, as are, to a lesser degree, floor decals (16%).

“Communication at shelving is very effective for customers,” one retailer noted.

Among other results, the study confirms that in these difficult economic times, retailers are shifting their attention to more value-oriented promotions.

“We're putting more focus on lower/hot prices for the value shopper,” said one retailer.

“There's much more emphasis on [everyday low pricing] and long-term price reduction via temporary price reductions,” said another.

“We are spending more of our money on promotions to drive down retails in order to ensure our low-price image,” said yet another.

The Internet is also a valuable promotional tool, as retailers report more targeted marketing efforts via e-newsletters and other online tools.

“We're sending emails to loyalty card holders notifying them of upcoming sales events and coupons,” one retailer said.

Distribution Methods

FSIs remain the No. 1 coupon-distribution method, but the Internet and other tools are also getting attention.

MANUFACTURERS: Which of the following coupon vehicles has your company or division used this year?

| FSI/newspaper | 36% |

| Circular | 33% |

| In-store, non-electronic | 33% |

| Internet | 29% |

| In-pack/on-pack | 25% |

*Respondents could select more than one answer

Media Moguls

In-store media is a favorite among manufacturers.

MANUFACTURERS: Which media most effectively supports your consumer promotions?

| In-store media, non-electronic (floor decals, at-shelf signs, etc.) | 51% |

| Internet | 25% |

| Magazine | 24% |

| Newspaper | 22% |

| TV/cable | 22% |

| In-store media, electronic | 15% |

*Respondents could select more than one answer

Tailor Made

Manufacturers are customizing promotions to meet the needs of specific retailers.

MANUFACTURERS: Which of the following types of consumer promotions are you focusing more on now than in the past?

| Account/retail-specific | 73% |

| Coupon promotions | 29% |

| Internet marketing | 29% |

| Joint promotions with non-competing brands from other companies | 20% |

| Ethnic marketing | 11% |

*Respondents could select more than one answer

Show and Tell

Product displays are key for retailers.

RETAILERS: Which types of in-store media are you requesting more from manufacturers?

| Displays | 57% |

| At-shelf signs | 41% |

| Floor decals | 16% |

| Other | 13% |

| No answer | 11% |

*Respondents could select more than one answer