Walmart has been quietly developing a paid membership program called Walmart+ to counter rival Amazon’s hugely successful Prime customer benefits offering.

A Walmart spokeswoman on Friday confirmed that the Bentonville, Ark.-based retailer has created a membership program named Walmart+ but declined to provide further details. News that Walmart was hatching a Prime competitor emerged yesterday when Vox/Recode reported that the retail giant has been working on a paid membership program with a range of customer benefits over the past 18 months.

Citing unnamed sources, Vox/Recode said Walmart is slated to begin public testing of Walmart+ as soon as in March. The program, at launch, is expected to be based on Walmart’s Delivery Unlimited online grocery service, according to the report. Expanded this past fall after a soft launch before the summer, Delivery Unlimited lets users pay an annual $98 fee or a monthly $12.95 fee for no limit on grocery orders of $30 or more. The unlimited delivery option is now available in 1,600-plus stores.

Other potential Walmart+ benefits, Vox/Recode reported, could include placing orders via text message — a capability pioneered by Walmart’s now shut Jetblack e-commerce service — as well as “perks” like prescription drug and fuel discounts at Walmart pharmacies and gas stations.

Other potential Walmart+ benefits, Vox/Recode reported, could include placing orders via text message — a capability pioneered by Walmart’s now shut Jetblack e-commerce service — as well as “perks” like prescription drug and fuel discounts at Walmart pharmacies and gas stations.

The report said another function that might return under Walmart+ is Mobile Express Scan & Go, which Walmart discontinued in mid-2018, except at Sam’s Club. The apps allows users to scan items as they shop and pay for them without having to wait on line at checkout.

In terms of the cost of Walmart+, Walmart may stick with the Delivery Unlimited fee or test several price points, sources told Vox/Recode. The report noted that Walmart is aiming for the benefits package of Walmart+ to differ from that of Amazon Prime.

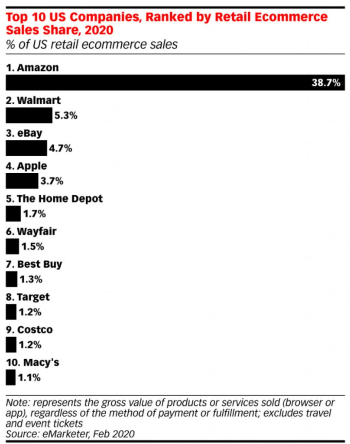

The creation of a membership program reflects Walmart’s efforts to turn up the heat on Amazon, which continues to holds a big lead in U.S. online retail market share. Digital commerce specialist eMarketer reported this week that Amazon leads the field with 38.7% of U.S. retail e-commerce sales, well ahead of No. 2 Walmart at 5.3%.

Prime has proved to be a bonanza for Amazon and now has more than 150 million members, up from over 100 million in April 2018. That growth came even after Seattle-based Amazon hiked Prime’s annual membership fee from $99 to $119 in May/June 2018.

Online grocery has been a a key battlefield for Walmart and Amazon in the e-commerce arena, with Amazon leveraging its successful Prime customer benefits program.

Grocery has been a competitive battleground, and Amazon fired a big salvo in late October when it made its AmazonFresh perishables delivery service a free benefit under Prime. As a result, free grocery delivery is now part of the Prime benefits package, since Amazon’s Prime Now and Prime Pantry programs already offered members free delivery on orders of at least $35. Previously, AmazonFresh delivery cost $14.99 per month on top of the $119 annual Prime membership. Prime Now also includes delivery and pickup from Whole Foods Market stores in select cities. Overall, Amazon now provides fresh grocery delivery in more than 2,000 cities and towns, and the company said it plans to expand delivery and pickup service to more areas.

Prime also has lured members with an expanding array of benefits that could be tough for Walmart to match. Through Prime, members get unlimited streaming of movies, television shows and music; unlimited access to e-books; special access to deals and exclusive savings; photo storage; and free same-day and one- or two-hour delivery on millions of items, among other benefits.

Walmart makes more e-commerce moves

Along with Walmart+, Walmart continues to fire back at Amazon. This week, the retailer introduced Walmart Fulfillment Services (WFS), in which sellers in its online marketplace can leverage the Walmart fulfillment network and supply chain to fill and ship orders — a shot back at Amazon Marketplace, whose third-party sellers account for more sales than Amazon.com.

Also, on Tuesday, Walmart U.S. CEO John Furner and U.S. eCommerce CEO Marc Lore said in a company memo that it plans to consolidate its U.S. merchandising organization into one omnichannel team.

That structure will cover six categories, including consumables, led by Executive Vice President Latriece Watkins; food, led by EVP Charles Redfield; apparel, led by Andy Barron, EVP of softlines and general merchandise; home, led by Anthony Soohoo; entertainment, toys and seasonal, led by EVP Jeff Evans; and hardlines, led by senior VP Diana Marshall.

“Eventually, these six teams will buy every item sold by Walmart in the U.S. Consumables and cood will start immediately, with these e-commerce teams joining the organizations led by Latriece [Watkins] and Charles [Redfield],” Furner and Lore said in the Feb. 25 memo. “The other four areas will come together over time as the e-commerce fashion, entertainment, enthusiast and professional and home areas merge with the categories listed above. We’ve asked Chandra Holt to serve as chief merchandising and integration officer for Walmart eCommerce, and lead the work that will create an omni-merchandising organization.”

For fiscal 2020 ended Jan. 31, Walmart’s e-commerce sales rose 30% year over year, including a 35% gain in the fourth quarter. Walmart said its U.S. eCommerce arm posted strong growth in grocery pickup and delivery, while Walmart.com saw its highest quarterly growth rate of the year in the fourth quarter. As of the fiscal year-end, Walmart U.S. had nearly 3,200 grocery pickup sites and more than 1,600 delivery locations.