Against Aldi and Lidl, personalization is the smart move

Competing directly on price is losing strategy, says Brick Meets Click

Knowing your customers and making relevant offers — not engaging in a price war — is the way for supermarkets to prevent fast-growing hard-discount grocers Aldi and Lidl from siphoning market share, according to Brick Meets Click.

Because of their private label-driven, operationally efficient business models, Aldi and Lidl can offer prices 30% to 40% below the regular price of branded groceries sold in supermarkets, noted Bill Bishop, chief architect at the Barrington, Ill.-based strategic advisory firm. Grocery retailers that cut their prices in response only end up killing their margins — an unsustainable strategy, he said.

“Supermarkets must stop lowering their prices and eroding margins in response to hard discounters. It’s a price battle they just can’t win,” Bishop explained.

Instead, he said, supermarkets can counteract Aldi and Lidl by concentrating on their strengths: serving up weekly specials — which often beat the hard discounters’ prices — and spotlighting the products and prices that individual shoppers care about the most.

The bottom line: Change the game plan from overall price perception to personalized value.

“Supermarkets already have the necessary tools in their arsenal in the form of loyalty data and the weekly circular,” according to Bishop. “By combining them in the right way, they now have the opportunity win the shopper and the sale, without destroying their margins and their profitability.”

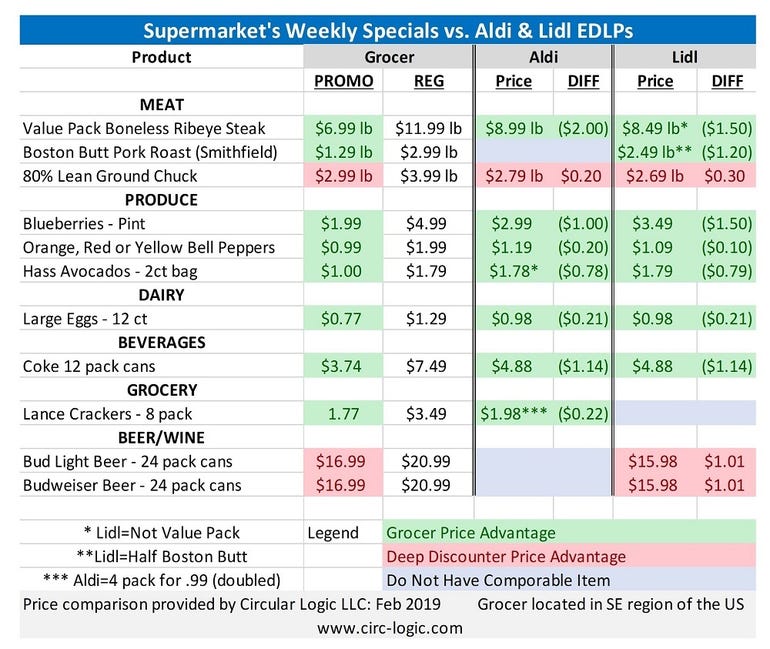

For instance, a supermarket’s weekly advertised prices are frequently lower than everyday low pricing from Aldi and/or Lidl, Brick Meets Click noted. According to price data for one week in February collected by Circular Logic LLC, a Southeastern grocery retailer had the price advantage for eight out of 11 of its front-page circular features based on comparable or the same items.

Bishop called the weekly circular “a secret weapon for supermarkets that’s an often-overlooked source of price advantage.”

To capitalize on weekly pricing edge, supermarkets need to personalize the ad by providing offers relevant to each shopper, said Bishop. That can be done by cross-matching data from the supermarket’s loyalty program with its weekly promotions to flag the items most wanted by each household and then sending a personalized email highlighting the 10 most relevant items to the shopper each week.

Such personalized emails bolster the supermarket’s price reputation with the shoppers receiving them and yield more product sales, without the need to step up markdowns, according to Bishop. Retailers currently partnering with Charlotte, N.C.-based Circular Logic find that the personalized emails also are more likely to be opened by consumers, Brick Meets Click reported.

“Grocers have to adapt to Aldi and Lidl’s impact on pricing in the market, but lowering prices to fight the competition on general price reputation is counterproductive,” Bishop added. “Shifting the goal to winning the individual shopper can be a much more effective and profitable strategy, and the good news is that now there’s a way to do it.”

Bishop recently shared his insights on the competition presented by the hard discounters at the National Grocers Association Show in San Diego.

Supermarket operators’ concerns about Aldi and Lidl have risen as both of the Germany-based retailers work to boost their U.S. market share. Aldi is amid a five-year, $5 billion-plus expansion program that will remodel most of its locations by 2020 and grow the chain (now with about 1,800 stores) to 2,200 by 2022. Meanwhile, Lidl has reset its real estate strategy and grown to over 65 locations since launching in the United States in June 2017. The chain continues to be held in high regard by American shoppers and, in late 2018, acquired Best Markets, giving it 27 stores in the lucrative metro New York market.

About the Author

You May Also Like