German grocers Aldi and Lidl are taking the U.S. grocery market by storm, but while the two discount grocers expand rapidly across the country, they appear to be targeting different customers, according to a new report from data analytics firm Placer.ai.

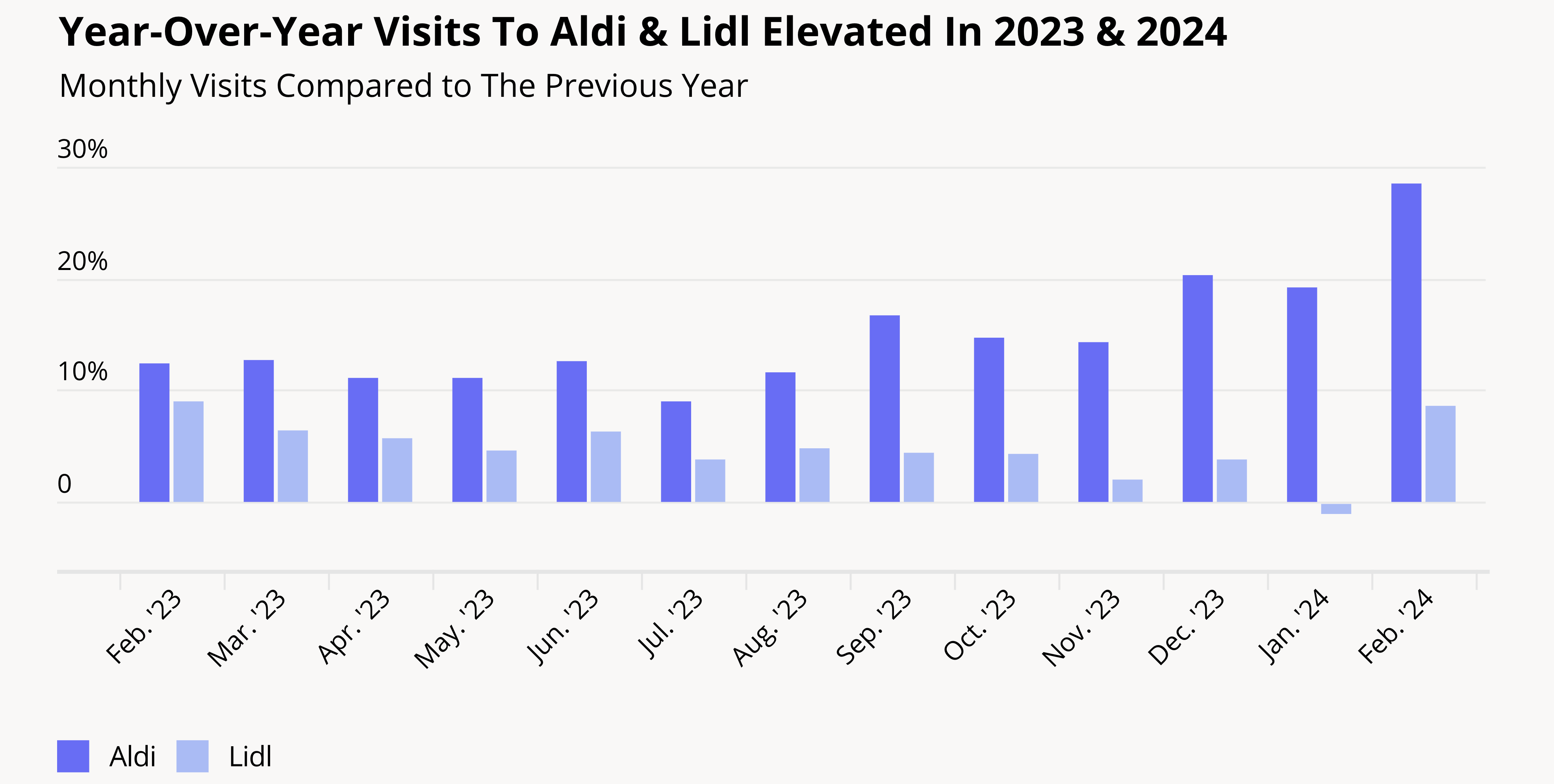

The report “Aldi & Lidl Making the Cut” shows that Aldi experienced increased year-over-year and month-over-month visits between February 2023 and February 2024. During that same period, Lidl experienced year-over-year monthly visit increases, except for January 2024.

Placer.ai attributed part of Aldi’s growth to the chain’s rapid expansion across the U.S. Aldi announced plans to open 120 news locations in 2023, and earlier this year, the grocer said it will open 800 additional U.S. locations by the end of 2028.

As of April 9, Aldi had 2,372 U.S. locations, according to data analytics site ScrapeHero. Meanwhile, Lidl reports 174 locations, as of March 6, according to ScrapeHero.

Those Lidl stores are primarily located on the East Coast, and while the chain is also expanding, it is doing so at a slower pace.

That’s not the only difference between the two discount grocers. According to Placer.ai, they appeal to different demographics.

Placer.ai’s analysis shows that in 2023, the median household income of $68,100 a year in Aldi’s trade area was slightly below the nationwide median of $69,500. Aldi’s potential market median was even lower at $66,900.

“This indicates that Aldi locates its stores in areas that are accessible to the average consumer and succeeds in attracting also the slightly lower income segments within its potential trade area,” the report said.

Lidl’s potential market median was higher than the national median at $78,800, and its median household income of its captured market stood at $88,100 a year. This indicates that Lidl’s stores are located in more affluent areas, the report noted.

Aldi and Lidl also differed on the percentage of households that shop at their stores that have children. Aldi almost mirrored the national average of 27.6% of all households, while Lidl was slightly higher with 29.5% of its captured market and 28% of its potential market.

The numbers show “Aldi’s success in reaching the average U.S. grocery shopper,” according to the report.

Placer.ai also noted that Lidl attracts a wealthier suburban demographic, while Aldi tends to see more blue-collar shoppers. Those falling under the “Small Town Low Income” category made up 7.5% of Aldi shoppers and 0.9% of Lidl shoppers.

Similarly, 16.7% of Lidl shoppers are classified as “Upper Suburban Diverse Families” compared to 10.6% of Aldi shoppers.

The demographic breakdown appears to be playing out in terms of location, according to Placer.ai, with Lidl opening stores in larger East Coast cities and Aldi focusing on smaller cities.