Consumers are snacking more than ever, but the nature of their snacking is evolving to become more mindful, which is allowing for considerations around both health and indulgence.

“Overall, shoppers said they would like to have healthier snack options, but not at the expense of taste,” said John Bierfeldt, executive VP, client development, at Acosta, which conducted a focused survey with its proprietary community of U.S. consumers on shopper behaviors around snacking and candy this spring.

While two-in-five shoppers said they are buying less candy and snacks, most also said they snack on a daily basis, and that despite inflation and tighter budgets, they’ll occasionally splurge on these items, he said.

“Perhaps this is because 68% of shoppers describe snacks as ‘comfort food to feel better,’” said Bierfeldt.

The top three go-to snacks for comfort, cited by consumers in Acosta’s research, were ice cream, chocolate, and potato chips. Popcorn has also proven itself as an inflation-proof, go-to snack,” Bierfeldt said.

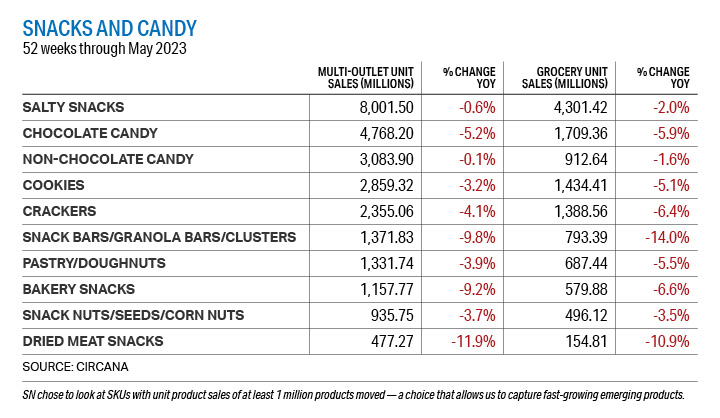

Although Circana data showed that most top-selling snacks and candy fell into the same pattern as other center store categories, with higher dollar sales and a decline in units, a few showed especially sharp declines in the past year. These included granola bars and meat snacks, which may have suffered from especially high sales in previous years, said Sally Lyons Wyatt, executive VP and practice leader at Circana.

In addition, she said, consumers may be finding the functional benefits of these products in other foods, and from places other than grocery stores.

“Some of these snacking categories are being impacted because the consideration set is much larger than ever before,” said Lyons Wyatt.

Acosta’s research found that Millennials, who lean toward healthy snack options, are still interested in bars and meat snacks, however. About two-thirds of Millennials surveyed — 67% — reported buying granola and cereal bars, 54% bought protein or nutrition bars, and 53% said they bought dried meat or jerky.

“The biggest challenge for manufacturers is that the definition of ‘healthy snacking’ differs significantly by generation, with Millennials focusing on clean ingredients, natural and organic, and high protein, and Boomers focusing on low sugar, fat, calories, and carbs,” said Bierfeldt.

The Acosta research also showed that 74% of consumers said they snack at work, and 63% said they snack while traveling. In fact, return to traditional work routines after the pandemic may be influencing the category as well, said Tabitha Sewell, director of category management at KeHE Distributors.

“Healthy snacking and grab-and-go items are in high demand as people are back to their daily commute and busy schedules,” she said, adding that consumers seeking healthy, savory snack options are looking for high protein, added nutrients, and natural ingredients, “if the snack delivers on taste.”

Indulgence remains a factor as well, said Lyons Wyatt, who said indulgent snacks have been gaining share in Circana’s annual exploration of the snack category, which divides snacks into four categories.

“For the last couple of years, indulgence has continued to gain share from the other segments,” she said.