More food retailers focus on health, well-being of employees and shoppers

As programs increase, priorities range from nutrition to self-care and health education

July 30, 2021

Food retailers increasingly support health and well-being activities for their employees and customers, according to the "2021 Report On Retailer Contributions To Health And Well-Being" recently released by FMI-The Food Industry Association.

"We're seeing a dramatic increase in efforts by food retailers to expand health and well-being programs and activities," Krystal Register, a licensed dietitian/nutritionist and director of health and well-being at FMI, said in a statement released with the study.

Responses to the survey, conducted in March and April, were received from 27 food retailers, representing more than 26,000 stores of all sizes. For perspective, FoodIndustry.com reported in November that the top 10 grocery chains in the United States operate approximately 14,481 stores.

10 key takeaways from the report

1. Sharp growth in programs

Food retailers are increasingly strategic about their health and well-being efforts:

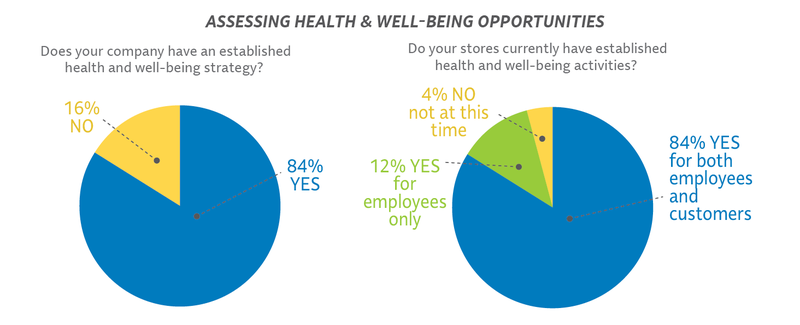

84% of companies surveyed have an established health and well-being strategy.

84% of companies' stores have established health and well-being activities for both employees and customers, up from 49% two years ago.

12% have established activities for employees only.

Compared to 2019, most food retailers have increased their health and well-being programs:

31% increased significantly.

19% increased moderately.

12% increased slightly.

19% remained the same.

19% decreased

2. Pandemic scrambles and enhances strategies

The COVID-19 pandemic disrupted many retailers' health and well-being activities, with some moving to virtual activities.

54% said COVID-19 shifted the focus of the programs and activities.

31% said they put a greater emphasis on health and well-being activities.

15% said they had to put health and well-being programs on hold.

3. Priorities range from nutrition to self-care

Companies identified their top priorities for their health and well-being initiatives:

Nutrition and overall health, 31%.

Well-being, including self-care and preventative care, 15%.

Food and human safety, 12%.

E-commerce, 15%.

The companies identified the top two operational barriers to implementing these plans as competing priorities and return on investment.

4. Omnichannel approaches lift efforts

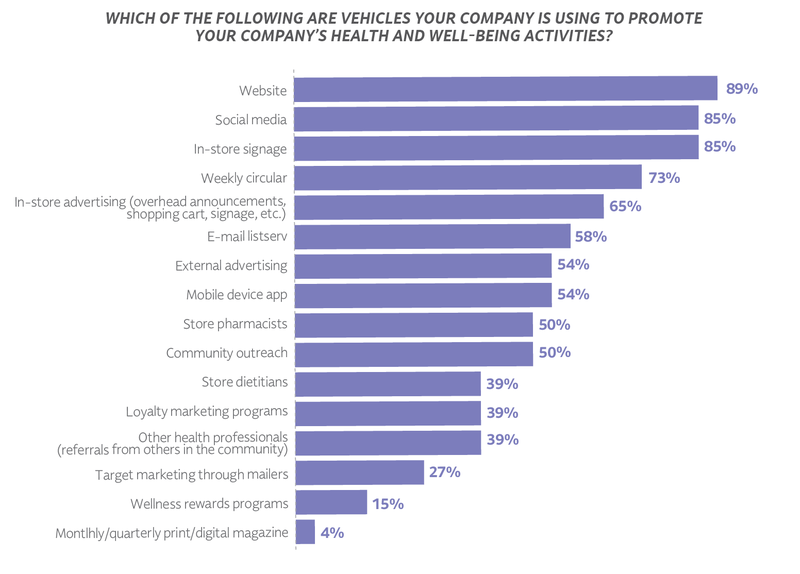

Just as food retailers take an omnichannel approach to marketing their products, they are taking advantage of several channels, both digital and print, to market their well-being programs.

Half or more of the companies surveyed use at least one of these vehicles to promote their health and well-being activities:

Website, 89%.

Social media, 85%.

In-store signage, 85%.

Weekly circular, 73%.

In-store advertising such as announcements, shopping carts, 65%.

E-mail listserv, 58%.

External advertising, 54%.

Mobile device app, 54%.

Store pharmacists, 50%.

Community outreach, 50%.

Less commonly used resources include store dietitians, loyalty programs, direct mail and wellness rewards programs.

Many programs are offered both in-store and virtually, by varying degrees:

Good-for-you products, 76% in-store, 40% virtually.

Healthy recipes, 50% in-store, 81% virtually.

Budget friendly solutions: 52% in-store, 60% virtually.

Family meal programming, 50% in-store, 58% virtually.

Allergen information and resources, 48% in-store, 60% virtually.

5. Employee wellness gains in importance

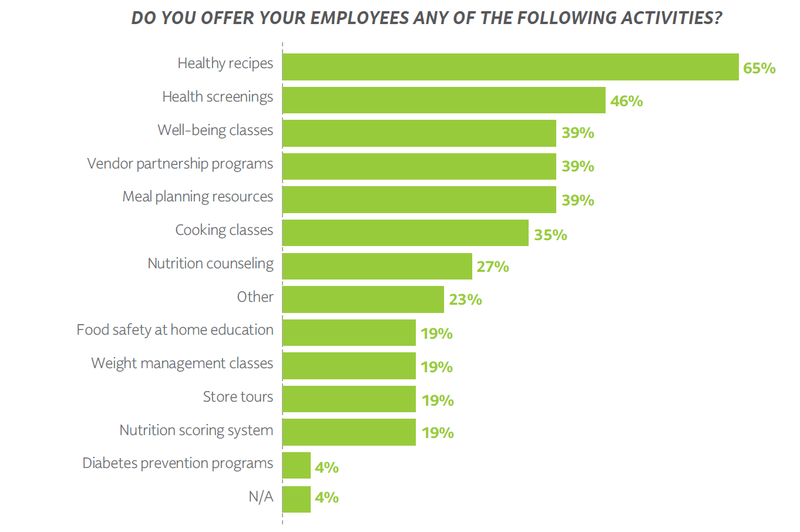

Among the health and well-being programs offered to employees, these are the most common:

Healthy recipes, 65%.

Health screenings, 46%.

Well-being classes, 39%.

Vendor partnership programs, 39%.

Meal-planning resources, 39%.

Cooking classes, 35%.

Nutrition counseling, 27%.

Some programs that prioritize employees' well-being are weight management classes and food safety, but both of these were offered by only 19% of employers.

6. Retail branding takes spotlight

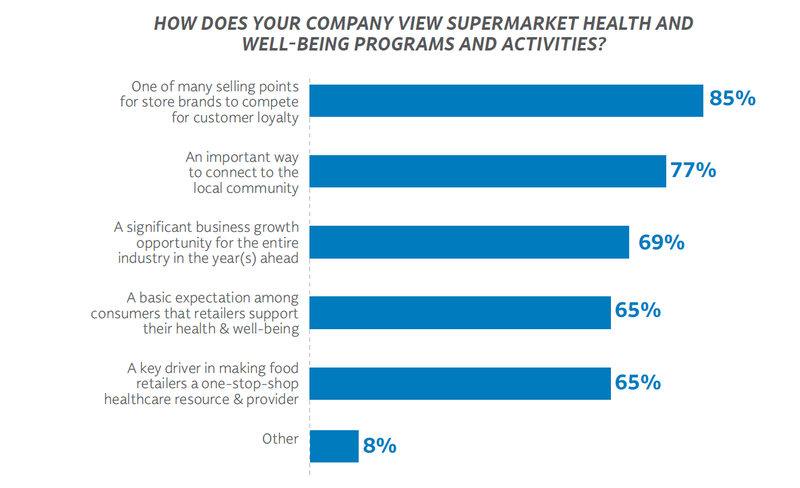

Food retailers see their health and well-being programs as good business:

A selling point to compete for customer loyalty, 85%.

An important way to connect to the community, 77%.

A significant growth opportunity: 69%.

Customers expect retailers to support their health, 65%.

A driver to make food retail a health care resource: 65%.

In the 2019 survey, only 54% of retailers considered their health and well-being programs to be a selling point.

7. Community engagement is key driver

Health and well-being programs provide big opportunities for community partnerships. In the coming year, food companies are planning partnerships with these organizations:

Health insurance providers, 77%.

Health organizations such as the American Heart Association, 69%.

Local hospitals or health care networks, 65%.

Worksite wellness programs, 54%.

Health education plays major role

The survey found that 65% of stores employ registered dietitians at the corporate level, and 31% have dietitians available in stores or virtually. Although no dietitians work at the C-suite level, 48% work in strategic leadership roles, according to FMI.

Many food retailers use their websites and mobile apps to educate customers about health and well-being:

Vaccine information, 72%.

Community or in-store health programs, 68%.

Common health concerns, 60%.

Pharmacy locator/services, 60%.

Food allergies and intolerances, 44%.

Reading labels and packaging, 44%.

Submit questions online to a dietitian, 44%.

Stress management, 36%.

9. Collaboration drives progress

Pharmacists, dietitians and other healthcare providers are working together more to develop retail programs: 54%, up from 42% in 2019. They also are referring customers and employees to the other professionals.

Dietitians also work with culinary teams to develop healthy recipes or meals that align with health and well-being guidelines. More than 67% of respondents reported that they employ a chef or culinary professional at the corporate level.

Retailers measure their return on investment in dietitians in several ways:

Customer participation in dietitian-led programs, 70%.

Overall success of the health and wellness program, 65%.

Social media engagement, 50%.

Consumer surveys, 40%.

Increased sales of products that dietitians promote: 40%.

10. Many approaches to measuring success

Food retailers use both qualitative and quantitative targets to measure the success of their health and well-being programs:

Participation/attendance in activities, 83%.

Employee insurance claims, 67%.

Informal employee feedback, 67%.

Consumer comments, 58%.

Surveys, 58%.

Using a scale of 1 to 5, with 5 being the most useful, retailers reported these measures as the most useful:

Sales figures, mean 4.6.

Health outcome/biometrics, mean 4.4.

Participation/attendance, mean 4.3.

Health risk assessments, mean 4.3.

Loyalty programs, mean 4.3.

Steps for further progress

These takeaways show food retailers how to become key destinations for health and well-being needs. Alongside, FMI presents five steps for progressing further:

Mine the experiences of the pandemic to reset strategies and capture the benefits of health and well-being programs.

Meet shoppers where they are, even as the pandemic starts to recede. Look for health and well-being opportunities throughout the store, then bring in experts such as dietitians to develop strategy.

Determine how to measure disease prevention, which would illustrate the effectiveness of your efforts.

Consider new opportunities to engage with the community, such as food assistance programs, wellness screenings and even immunization initiatives.

Take advantage of collaboration between pharmacists, dietitians and other health care providers.

This article originally appeared on New Hope Network, a Supermarket News sister website.

About the Author

You May Also Like