Informative reports and graphics on the latest sales data and consumer trends in key grocery categories, from fresh market to center store.

Organic produce continues growth, with sales up 9.3% in Q1

Eight of top 10 organic produce categories showed increases in dollars and volume

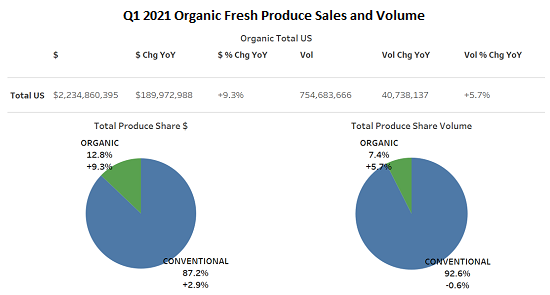

Total organic fresh produce sales for the first quarter of 2021 saw a continuation of last year’s growth, increasing by 9.3% from the same period in 2020 and topping $2.2 billion for the quarter, according to the Q1 2021 Organic Produce Performance Report released this week by Organic Produce Network and Category Partners.

Organic fresh produce sales and volume in the first quarter of 2021 maintained a trend established in March of last year, with elevated sales across the entire supermarket, as consumers continued at-home eating in light of restaurant closures. However, moving into the second quarter of 2021, it is apparent that the pandemic closures are beginning to ease, and the question has now become if — and how fast — consumers will return to their pre-COVID food purchasing behaviors, the report noted.

Source: Organic Produce Network and Category Partners

“Once again, sales of organic fresh produce continue to be a major growth opportunity for retailers across the country. At the same time, as the country enters a post-COVID environment, with restaurants reopening and other foodservice options available, it appears the double-digit growth rate will be slowing,” said Matt Seeley, CEO of Organic Produce Network.

The quarterly increase outpaced conventional produce sales, which grew by only 2.9%. Organic fresh produce volume grew by 5.7%, while conventional volume saw a decline of 0.6%.

Source: Organic Produce Network and Category Partners

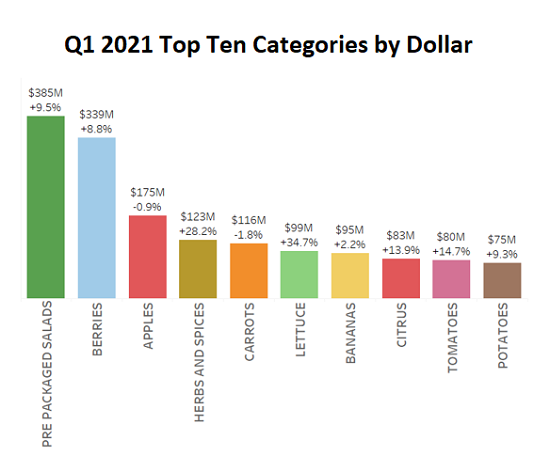

The top 10 organic produce categories continued to perform very well, with 8 of the top 10 categories generating increases in both dollars and volume. Of these top 10 categories, only organic carrots and apples failed to generate year-over-year dollar and volume gains during the first quarter.

The top 10 organic categories drove 72% of total organic volume and 70% of total organic sales. In conventional produce, these same categories drive only 64% of total sales and 67% of volume.

Packaged salads remain the single largest driver of organic dollars, accounting for 17% of all organic sales. During the first quarter of 2021, packaged salad dollars saw a year-over-year increase of 9.5%. Organic berries have become a key winter category, according to OPN, driving over 15% of total organic produce dollars during the first quarter. Berries generated a year-over-year sales increase of 8.8%.

“Within the top 10 categories, fresh herbs ( 28.2%), lettuce ( 34.7%) and tomatoes ( 14.7%) generated the largest percentage gains in dollars,” said Steve Lutz, senior vice president for insights and innovation at Category Partners. “In terms of Q1 volume, bananas, carrots and apples rank as the top drivers of organic volume at retail, generating a remarkable 37% of total organic volume. Bananas alone drive 17% of all organic volume.”

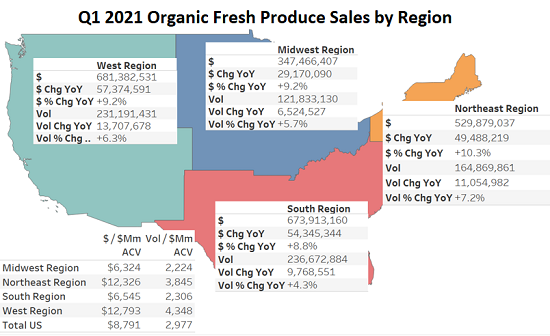

Source: Organic Produce Network and Category Partners

Year-over-year organic sales and volume increases during the first quarter of 2021 were strong in every region of the US. The West and Northeast are historically the strongest regions for organic produce sales and the two regions generated the highest increases in dollar growth.

The Q1 2021 Organic Produce Performance Report utilized Nielsen retail scan data covering total food sales and outlets in the US over the months of January, February and March.

About the Author

You May Also Like