A forum for contributed pieces from industry thought leaders, retailers, wholesalers and manufacturers. The views expressed are those of the authors.

Traditional supermarkets meet challenge to feed America while under siege from alternative grocers

The past year has proven just how critically important supermarkets are to our lives, says PJ Solomon’s Scott Moses

March 24, 2021

Scott Moses is a Managing Director and Head of Grocery, Pharmacy & Restaurants Investment Banking at PJ Solomon, the M&A investment banking advisory firm. He writes a quarterly column for Supermarket News about sector trends, including operating, valuation and strategic dynamics.

It has been over a year since the COVID-19 pandemic began to ravage the United States and most of the planet. While historians, epidemiologists and politicians will study, debate and needlessly politicize our collective response to the pandemic for years to come, one facet of that response is an incontrovertible fact: Our grocery sector — particularly our extraordinary network of traditional supermarkets — again answered the call and rose to the challenge to feed America during yet another storm. They retooled stores to keep teams and customers safe; they recalibrated the supply chain to accommodate unprecedented throughput; and last spring, as many people were compelled to lock down at home, our grocers were feeding over 300 million Americans billions of meals per week.

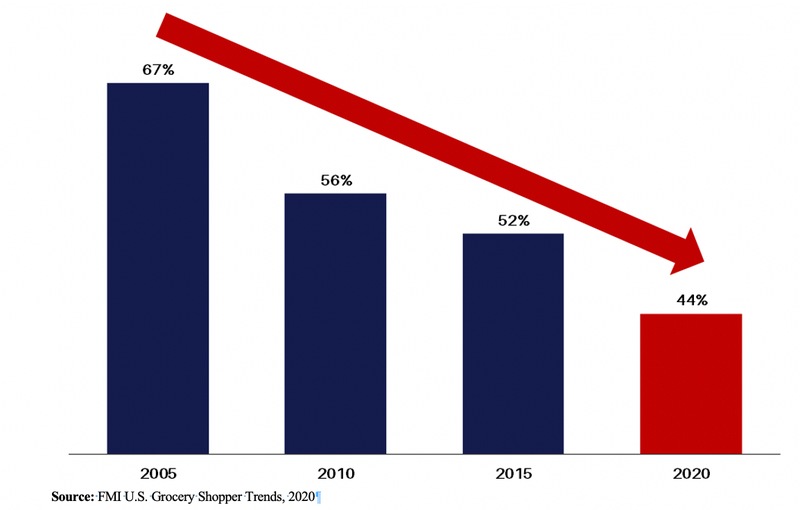

Always the last ones to leave a crisis and the first ones back in, supermarkets have been pillars of thousands of American communities for generations. After years of exponential grocery growth by retailers such as Amazon/Whole Foods, Walmart, Target, Costco, Aldi, Dollar General, Dollar Tree/Family Dollar, Walgreens and CVS, alternative grocers now comprise the majority of U.S. grocery sales. They are no longer just the “alternative,” but rather the largest and most well-capitalized grocery incumbents in many markets. As a result, our supermarkets have been somewhat taken for granted for years and are no longer the primary grocery store for a majority of Americans.

Alternative Grocers Account For More Grocery Sales Than Traditional Supermarkets

Supermarket As Shoppers’ Primary Store Channel (2005 - 2020)

However, over the past year, traditional supermarkets have proved again just how critically important they are to our lives as we fulfill our most basic responsibility, feeding and sustaining our families. The extraordinary demand experienced in the past year is poetic justice for supermarkets after their long record of extraordinary service to the country. Most supermarket comps were up over 10% for the year, and their EBITDAs were up 25% to 50%.

Recent Comparable Store Sales Growth

Data based on most recent quarter per company filings as of March 2021.

LTM EBITDA Growth

Data based on most recent quarter per company filings as of March 2021.

I am often asked by supermarket CEOs and boards what they should do with the additional cashflow. I would suggest this unexpected (but well earned) capital windfall can help our sector operators accomplish two critical imperatives: first, to deleverage and spend less cash flow on interest payments, in a sector that has been generally overleveraged for years; second, to make investments in price, wages, marketing, technology and growth, whether with new stores, online infrastructure, renovations or acquisitions.

This is particularly important given struggling consumers’ continued focus on price and the considerable investments that Amazon, Walmart, Aldi, Family Dollar and other alternative grocers continue to make in those areas, particularly in their rapidly growing online grocery ecosystems. Notably, Amazon’s EBITDA increased $11.8 billion in the past year; Walmart’s increased $1.9 billion and Dollar General’s increased $1.2 billion. In short, the additional cash flow generated by the pandemic should be invested to enhance supermarkets’ ability to evolve and compete.

CEOs and boards often also ask about our industry sales expectation for 2021. While it will likely be difficult to match 2020 revenue, there are various factors which suggest demand will remain relatively robust, particularly on a two-year stacked basis vis-à-vis 2019, which is a logical way to evaluate 2021 comps.

First, in an elevated unemployment environment like we currently have, consumers normally eat more food at home because it’s much less expensive than restaurants.

Second, over the past year, millions of Americans have been forced to become “amateur chefs,” making great, and often much healthier, food at home for most of their 21 meals each week.

Third, nearly one in six independent American restaurants closed in 2020, severely limiting seating capacity, particularly in northern areas where outside dining is less feasible in winter months.

Fourth, a meaningful percentage of people will take many months — if not years — to overcome their fear of sitting inside available restaurants, even after most Americans are vaccinated.

Finally, a significant percentage of American workers, who have grown accustomed to remote work, will likely work more days at home for the foreseeable future, thereby maintaining some portion of their at-home meals that would historically been eaten at work.

After this tumultuous year of unimaginable hardship, dislocation and fear, our country’s grocers have yet again been a towering inspiration. I look forward to witnessing another year of service by the millions of American grocery teammates who always manage to step up when we need them. I’ve never been more proud to be a member of this remarkable community of grocers that serves our country every day.

About the Author

You May Also Like