Candy, like many other categories in 2023, saw an historic rise in dollar sales, but that rise in sales came with a corresponding unit decline, as consumers purchased fewer items because of higher prices. However, the first few months of 2024 indicates a shift in that trend, with strong Easter sales being a good gauge of the health of the category.

Dollar sales for core snacks, including candy, grew 4.2% in 2023 in the grocery channel, according to the latest figures from Circana; however, total units were down 3.4%.

“Drilling into candy, retail prices are still tracking above a year ago at 9-10% so we’ll continue to see dollar sales increase at over 6% with units down 3%,” said Sally Lyons Wyatt, global executive vice president and chief advisor consumer goods and foodservice insights for Circana. “With consumers feeling macroeconomic pressures, we are seeing channels that deliver on value. For example, Dollar Club and ecommerce channels are growing as consumers seek value and pack size trade downs.”

Within confections, the trends are towards sharable pack sizes, more individually wrapped candy that contains 200 calories or less, and front-of-pack calorie labels, Circana data indicates.

“Over the last three months, we see strong double-digit volume growth from novelty non-chocolate candy — experiential type of candy, different forms,” Wyatt said. “Jerky continues to perform well with a 6% increase over the last 12 weeks.”

Nick Sabala, vice president of strategic insights and engagements for Advantage Solutions, said guilt-free indulgences featuring sugar substitutes and all-natural ingredients are trending for today’s buyer, and snack-size candies also are rising in popularity as a limited treat.

“Younger buyers are gravitating towards gummies and sour candy,” he said. “Combination candies (chocolate-covered gummies, sour-coated sweets, etc.) have also gained traction among younger buyers seeking a flavor experience.”

A healthier choice

Healthier, indulgent items appeal to a new class of consumers who are younger and more health conscious.

Kristin Alas, category manager at Gelson’s Markets, a regional supermarket chain operating in Southern California, said customers and vendors are looking for more sustainably sourced ingredients and fair trade practices.

“Definitely healthier options like lower sugar or more natural ingredients are on the rise,” she said. “I’m always on the hunt to find healthier but delicious tasting candies.”

Last year, Gelson’s did a candy reset, grouping together its better-for-you options making it more convenient for customers to view and shop the store’s healthier selection.

Leaning hard into marketing

Alas said she feels it’s still critical to do store demos allowing customers to sample candy and snack products before purchasing.

“We also have this great program that lets our vendors sample out full-size or sample-size product that goes out to our top rewards members,” she said. “I always tell vendors our customers might be shy going back for a second, third or fourth sample, so by providing full-size product they can enjoy at the comfort of their home and share with the family.”

Across core snacks, communicating healthy product benefits and educating via social/digital regarding new products is key, Wyatt said. After all, targeted marketing through digital retail media networks makes marketing personal. This is an essential tactic for reaching younger shoppers.

“In addition, there are many things influencing consumer decisions for total snacks,” she said. “For example, 35% of consumers are influenced by smartphone apps when making their snacking decisions, up 7.1% compared to 2019, while 34% of consumers are influenced by social media to learn about new products.”

Bundling with produce

The candy aisle at most stores has many of the same brands that have been around for generations, so it’s not always easy for a new brand or item to crack through on the shelves.

Still, newer items have ways of finding opportunities.

“I really look for items that bring a uniqueness to my set and products that not only taste delicious but have great packaging,” Alas said. “You can have an amazing delicious product but if the packaging is basic, customers will not buy it.”

The Salinas, Calif.-based Naturipe Farms recently launched its “Berry Buddies” lineup as a means of appealing to consumers looking for healthier snacks that incorporate fresh produce.

Steven Ware, vice president and general manager of value added fresh for Naturipe, said the crucial first step in getting the product in stores is securing distribution, followed by leveraging the communication tools preferred by retailers to engage with their customers effectively.

“While some retailers convey messages directly at the shelf, others utilize social media platforms to highlight new products,” he said. “However, the most effective approach is aligning with the communication methods familiar to their shoppers.”

While innovation has slowed over the last couple of years, Dan Sadler, principal of client insights for Circana, has seen innovation with new product forms, textures, more dual flavors/flavor infusions, and limited-time offers come into the marketplace recently.

“Consumer relevancy is important, so anything around a differentiated consumer experience will also resonate,” he said.

Private label continues to be an opportunity

Private brand candy and snacks have seen significant growth over the last five years, as retailers leverage these categories to differentiate their assortments, innovate with flavor, meet consumers’ dietary lifestyle needs and ultimately provide better overall value for shoppers.

“Private brand innovation, whether that’s limited-edition finds, seasonal programs, better-for-you varieties, or even dynamically paired flavors, help retailers drive traffic and build customer loyalty,” Sabala said. “According to data from our 2023 private brand intelligence report, more than three-in-four shoppers have a positive perception of private brands that launch new flavors and limited-time offerings. These respondents say these items contribute to their enjoyment of the in-store experience and keep them coming back to shop.”

In core snacks, private brands grew 1% in unit sales in 2023, according to data from Circana.

“Within core snacks, we find private label candy to be only about 3% of candy dollar sales, but dollar, volume, and units are all growing as consumers seek value,” Wyatt said. “67% of consumers state that when their budget is tight, they often switch to private label or store brand snacks. Even with the stated switch, both candy and snacks brands have strong equity with consumers which limits private label penetration.”

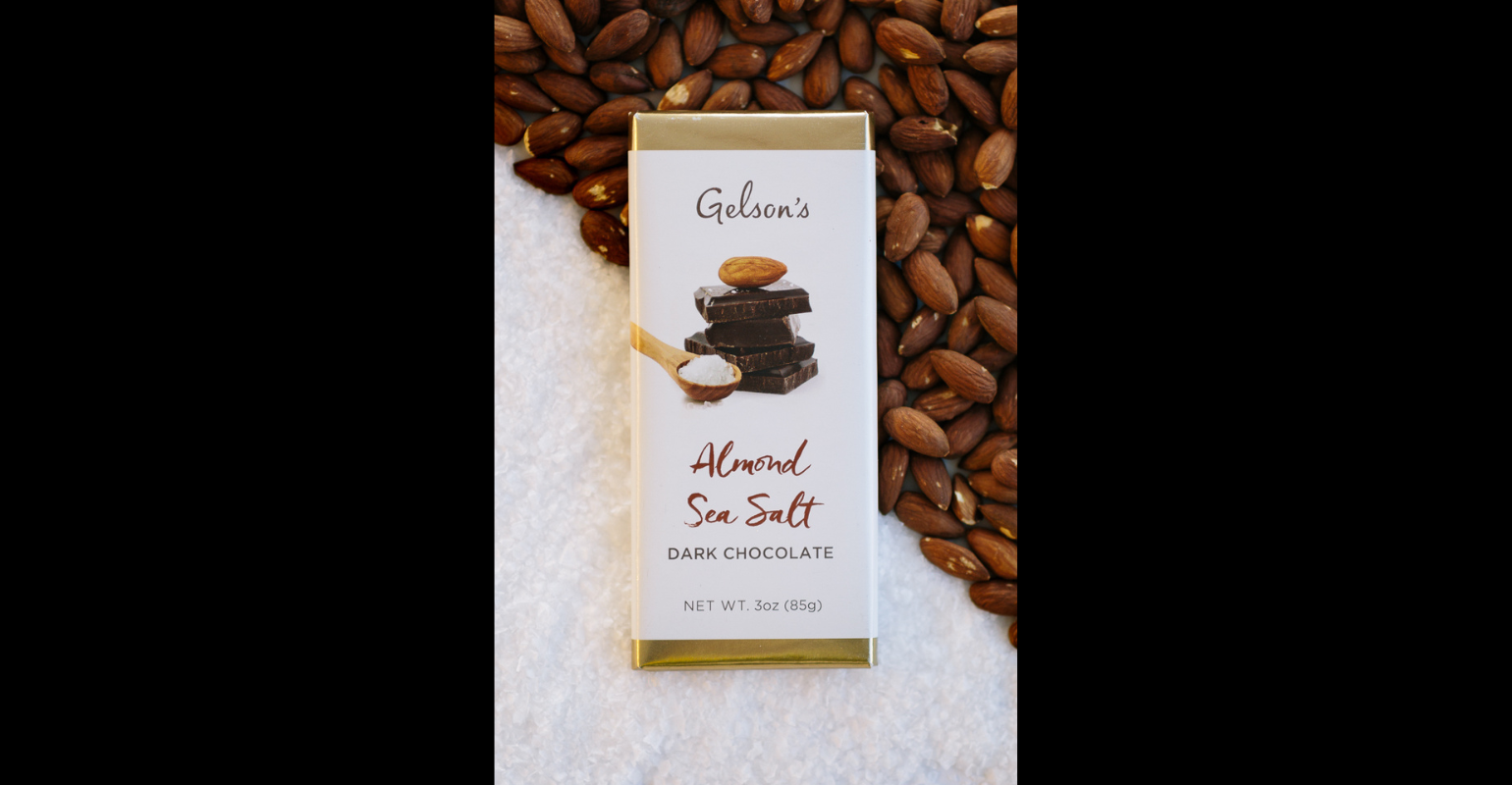

Gelson’s private label is crucial to its candy sales, according to Category Manager Kristin Alas.

“We are actually expanding our line of Gelson’s brand chocolates next month with some great new flavors,” Alas said. “There is so much that goes behind our private label.”

Gelson’s private label chocolate is a big seller.

Rich Gilmore, vice president of center store at Gelson’s, shared the expansion will include four new flavors — Dark Chocolate with Caramel, Dark Chocolate with Peanut Butter, Dark Chocolate Chai and Dark Chocolate Cold Brew.

“We chose these due to current trends in the category along with some unique twists that are not common in the segment, but will fit well with our customer tastes,” he said. “We believe the real value in the Gelson’s brand chocolate is that customers can only find it at Gelson’s. We are developing a following from consumers with a bit of a buzz around just how good the product is.”

In today’s landscape of candy and snacks, consumers are embracing a healthier approach to indulgence. With an increasing demand for sustainably sourced ingredients, fair trade practices, and lower sugar options, the market is ripe for innovative, guilt-free treats