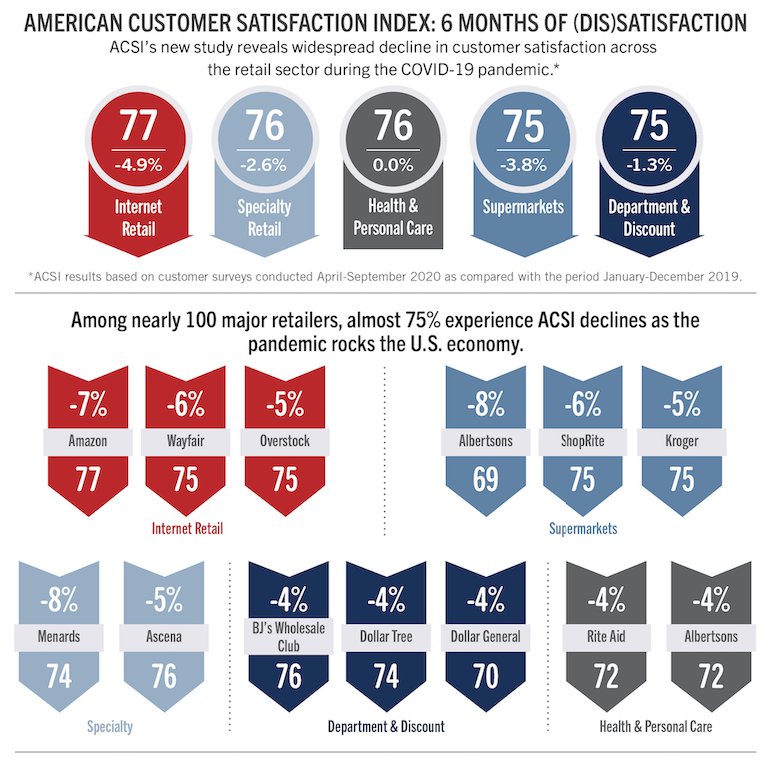

Shopper satisfaction with supermarkets fell during the first six months of the coronavirus pandemic, mirroring a trend across most of the retail sector, new research from the American Customer Satisfaction Index (ACSI) finds.

Among 100 major retailers across the supermarket, discount and department store, health and personal care store (including pharmacies), specialty retail and online retail segments, nearly 75% saw declines in customer satisfaction from April through September, ACSI said yesterday. The Ann Arbor, Mich.-based company’s special COVID-19 retail study was based on interviews with 30,787 U.S. consumers, who rated retailers by a score of 0 to 100 on a range of service criteria.

Supermarkets had an overall ACSI score of 75 for the six-month, down 3.8% from 78 at the end of 2019. That marked the second-biggest decrease among retail channels, behind online retailers, which scored 77, a 4.9% drop from 81 in 2019.

Discount and department stores — including mass merchants, warehouse clubs and dollar stores — rated at 75, a 1.3% dip from last year. Specialty retail stores had an overall score of 76, down 2.6% from 78 for 2019.

The only retail segment not seeing a decrease was health and personal care stores, which includes drugstores and in-store pharmacies. For the April-September pandemic period, the sector posted a score of 76, unchanged from its rating in 2019.

“From the onset of COVID-19, consumer expectations of retailers took a massive hit,” according to David VanAmburg, managing director at the ACSI, a national economic indicator developed at the University of Michigan. “Customers braced for delayed packages, empty grocery store shelves, and hard-to-find name brands. Of course, just because they expected this, doesn’t mean they were thrilled about it.”

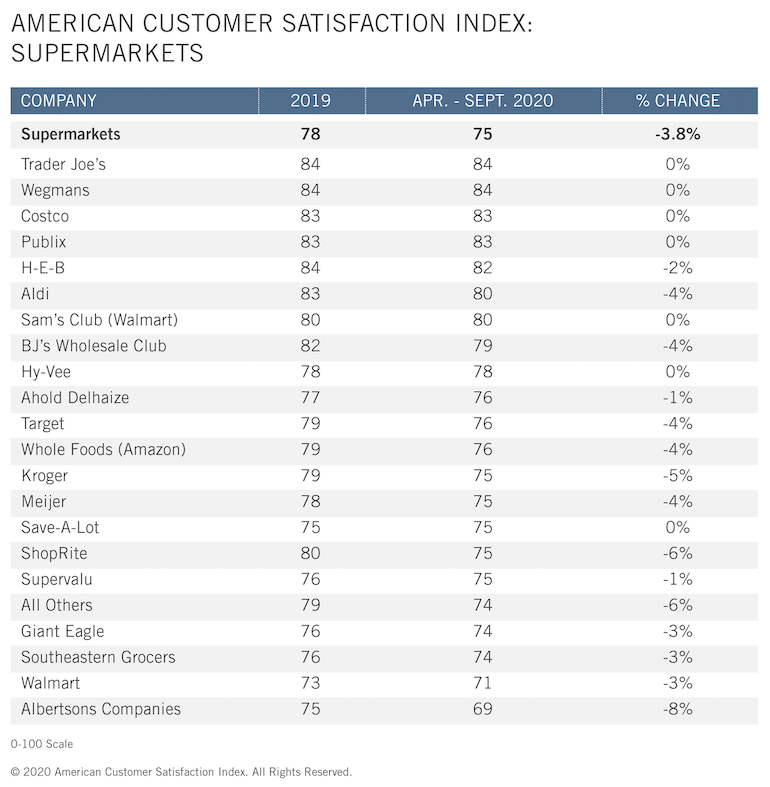

Among supermarkets and other grocery retailers — whose ACSI score last year was unchanged — Trader Joe’s and Wegmans Food Markets earned the top ratings from customers surveyed during the pandemic period, with both chains scoring 84, the same as in 2019.

Rounding at the top 10 for the six months were Costco Wholesale with a score of 83 (unchanged), Publix Super Markets at 83 (unchanged), H-E-B at 82 (-2%), Aldi at 80 (-4%), Walmart’s Sam’s Club at 80 (unchanged), BJ’s Wholesale Club at 79 (-4%), Hy-Vee at 78 (unchanged) and Ahold Delhaize USA at 76 (-1%).

The only other supermarket retailer not experiencing a decline was Save-A-Lot, which rated at 75 for customer satisfaction in the COVID period, repeating its overall score for 2019. ACSI said Albertsons Cos. score of 69 for April to September, down 8% from the retailer’s 2019 rating of 75, represented the first time a supermarket scored in the 60s since 2015.

“The effects of the pandemic on retail are especially pronounced in supermarkets. Aside from checkout speed, which remains steady at 76, all other customer experience benchmarks decline,” ACSI explained. “Keeping shelves stocked has been a major issue for the industry, with inventory sinking 6% to 75. Customers aren’t seeing many sales and promotions, and they’re uninspired by the number of locations.”

Costco turned in the highest ACSI score in the discount and department store category, with a rating of 81 for the six-month COVID period. Still, that marked a 2% falloff from the wholesale club chain’s 2019 score of 83.

Of discount/department store retailers in the food, drug and mass (FDM) channel, the only chains not seeing a decline in customer satisfaction was Walmart, which scored 71, unchanged from 2019, and Big Lots, whose 73 rating was the same as last year. Rounding out the 10 retailers in the FDM arena were Sam’s Club with a score of 79 (-2%), BJ’s at 76 (-4%), Target at 76 (-3%), The Kroger Co.’s Meijer at 75 (-1%), Dollar Tree at 74 (-4%), Fred Meyer at 72 (-3%) and Dollar General at 70 (-4%).

“Overall, department and discount stores improve in store layout, checkout speed, name brands, store locations and mobile app reliability,” ACSI reported. “However, customers feel the industry struggles with inventory availability, sales and promotions, and store hours since COVID-19, with the latter dropping 2% to 80.”

For drug retailers, shoppers rated the customer experience during the coronavirus crisis as essentially the same, according to ACSI. Survey respondents cited such improvements as a faster checkout process (up 1% from 2019 to a score of 77 ) and better mobile app reliability (up 2% to 83) but noted decreased availability of name-brand products (down 1% to 78).

CVS Pharmacy and Walmart were the only retailers in the health/personal care category with increased ACSI scores for the pandemic period, with CVS up 1% to 78 (from a 77 rating for 2019) and Walmart up 1% to 75 (from 74 in 2019). Rounding out the scores in this segment were Kroger at 77 (-1% from 2019), Sear’s Kmart at 74 (-1%), Walgreens at 73 (-3%), Albertsons Cos. at 72 (-4%) and Rite Aid at 72 (-4%).

“As customer satisfaction slips, retailers must adapt to the new market,” VanAmburg added. “It’s clear they have their work cut out for them.”