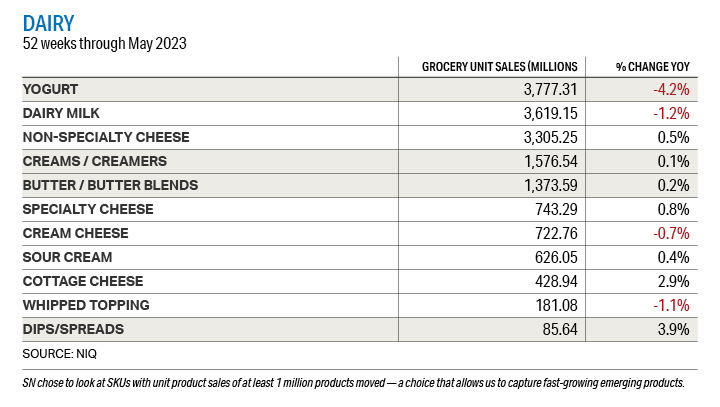

The largest two dairy items by dollar volume — cheese and milk — together generated more than $25 billion in annual sales, distantly followed by yogurt at $9.5 billion (+13.9% in annual sales), according to data from NIQ for the 52 weeks through May 2023. However, unit sales for those same categories show a decline for yogurt (-4.2%) and milk (-1.2%), as well as for cream cheese (-0.7%) and whipped toppings (-1.1%).

While the top three items experienced the most sales gains this year, also notable are the percentage increases in dollar sales of dairy items, including butter/butter blends (+27.1%), cream cheese (+22.7%), dips/spreads (+19.2%), sour cream (+18.4%), and creams/creamers (+18.5%).

While the rise of some of these items is certainly notable, so is the fact that unit sales remained fairly steady while inflation continued to impact the subcategory. For example, the oils, butter, margarine, spreads, and substitutes subcategory reported an average unit price change increase of 26.8%. Still, butter and butter blends saw sales and unit gains for the year despite the inflated prices.

“Dollar growth performance within dairy is also impacted by very different levels of inflation [similar to the meat category]. Cheese, for instance, has benefited from relatively low levels of inflation combined with strong consumer demand,” said Anne-Marie Roerink, president of 210 Analytics LLC.

Roerink also said that cheese plays in virtually all meal occasions from breakfast to dinner, and more importantly, is a protein-packed snack. Others, including cream/creamers, butter, and cream cheese are all experiencing growth that is largely driven by price increases, however, true performance will start to become clearer as we’re lapping double-digit inflation.

Dairy sales also continued to pace well ahead of year-ago levels in May 2023 and unit sales also remained steady. The May marketplace report by Circana and the International Dairy Deli Bakery Association (IDDBA), also shows that only a handful of dairy categories accomplished unit growth in May 2023 versus May 2022. This includes natural cheese, butter, cream cheese, whipped toppings, cottage cheese (in particular experienced strong demand), and cheese snack kits.

Scott Patton, vice president of national buying for Aldi said that the discount supermarket chain has been closely following consumer trends, jumping on the opportunity to gain share from the aforementioned butter blends subcategory. For example, “Over the past 18 months, more Aldi shoppers opted for dairy alternatives like plant-based milk, inspiring us to add a plant-based butter to our line-up this summer.”

Maria Brous, director of communications for Lakeland, Fla.-based Publix Super Markets, said that promotions, everyday value opportunities, and private-label items are showing strength in the dairy department.

“We look at the performance of categories and the various segments within each to identify trends,” she said. “We adjust our assortment and space based on these trends. Milk, eggs, and butter are still items purchased by most customers. These items are part of a large number of meal options and provide value. We see these as remaining very relevant to the customer in the coming years.”