Food retailers can do more to optimize the digital grocery experience for customers — and get a better return for themselves.

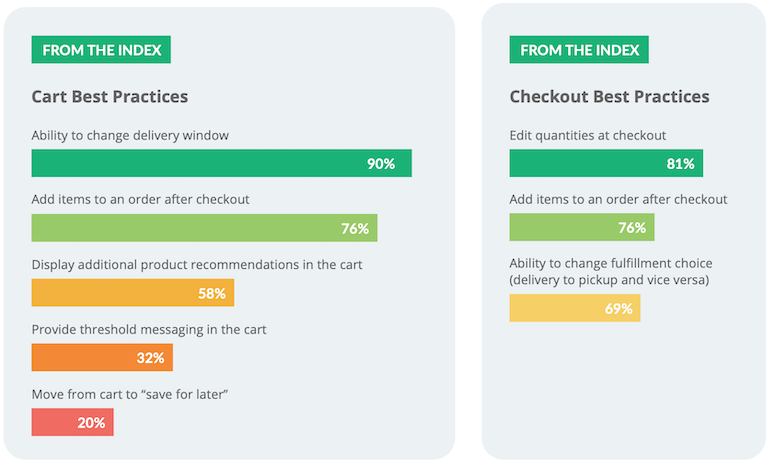

The OSF Digital 2022 Grocery Omnichannel Retail Index (ORI), released Monday, found that grocers are falling short in trying to increase what goes into shoppers’ virtual carts. For example, just 58% of food retailers recommend additional products in the cart before checkout, up from 35% in 2019, despite the fact that pitching complementary products or popular items together can boost basket size and provide more customers convenience, Quebec City-based OSF noted in the report.

What’s more, food retailers should give customers more leeway in changing online cart quantity. Though all food retailers in the Grocery ORI let customers edit quantity in their virtual cart, only 20% offer the ability to move items from the cart to a “save for later” status, whereas in other retail verticals the adoption rate is 40%, OSF’s research revealed, explaining that a “save for later” option enables customers to quickly return to a previously considered product and simply add it back to the cart instead of having to search for it.

OSF Digital said that, for the third annual ORI study, its omnichannel digital experts shopped 50 North American food retailers — 45 national/regional grocery chains and five warehouse clubs and supercenters — and evaluated them across more than 100 mobile, web and in-store criteria, based on OSF’s experience and knowledge of current omnichannel best practices for the customer journey. The findings were released in partnership with FMI-The Food Industry Association and the National Retail Federation.

With the COVID-19 pandemic greatly accelerating consumers’ shift to online, mobile and other digital channels, food retailers responded with significant omnichannel investments. OSF’s study said the implementation of best-practices criteria rose from 58% pre-pandemic to 65% currently. However, the research also showed that most grocery retailers remain behind in developing integrated, seamless and personalized experiences across all channels.

“Food retailers suddenly had to become omnichannel masters in a short period of time and often had to piece together multiple, distinct programs and solutions to meet customer demands,” according to Bernardine Wu, executive managing director of digital strategy at OSF Digital. “The latest Grocery Omnichannel Retail Index reveals that there are fragmented shopping experiences and therefore opportunities to develop a stronger seamless customer experience.”

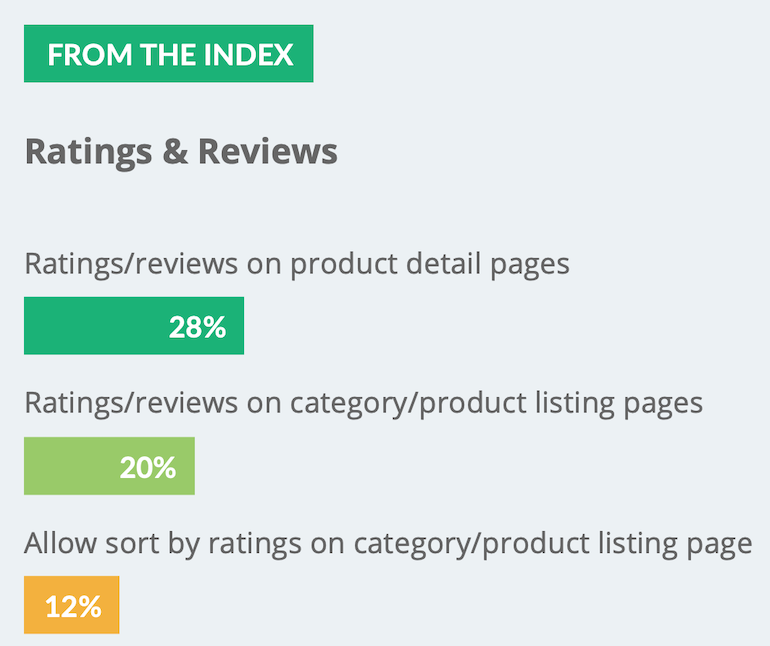

For instance, online consumers today have come to expect product ratings and reviews as they shop. Yet just 28% of food retailers examined offered ratings and reviews on their product detail pages and 20% on their category/product listing pages. Also, only 12% enabled ratings to be sorted on category/product listing pages.

On personalization front, a lot of food retailers may be missing a clear opportunity to snare customer data by enabling shoppers to manage preferences in the account section, such as which types of emails to receive and how often, preferred brands, dietary preferences, etc. The ORI report noted that this simple capability can yield valuable information to ensure communications with customers are highly relevant and targeted on an individual bases. Less than half (42%) of retailers examined offer advanced account settings, although that’s up from only 4% in 2019.

Other key findings in the ORI study included the following:

• 88% of food retailers offer both delivery and pickup service, up from 11% in 2019 (pre-pandemic).

• 51% of retailers outsource grocery e-commerce and fulfillment (pickup and delivery) to a third-party vendor, and 49% manage digital commerce and fulfillment in-house.

• Only 32% of grocery retailers provide threshold messaging in the online cart to highlight delivery and pickup order value minimums or promote free shipping.

• 69% enable customers to change their fulfillment choice at checkout (such as from delivery to pickup or vice versa).

• 67% offer shoppable digital fliers, yet just 48% of retailers allow consumers to add products to a virtual cart from online content.

• 76% let shoppers move items from a digital shopping list to their cart, but only 28% allow shoppers to share their list with others in their household.

• Free shipping with a threshold is offered by just 17% of food retailers evaluated in the ORI — versus 79% in other verticals — and 51% provide free shipping via a paid membership program.

“The Grocery Omnichannel Retail Index is a critical tool for food retailers with insights on how to place the customer at the center of the experiences they create,” stated Gerard Szatvanyi, CEO of OSF Digital. “It can be used to identify gaps in customer experience in order to ease shopping, drive conversion and increase loyalty.”