Amazon Fresh sets foot in metro New York with latest stores

Amazon also eyes expansion for new Amazon Go c-store formats

July 25, 2022

Amazon has brought its Amazon Fresh supermarket banner into the New York metropolitan area as part of five new-store openings this month as well as launched its second Amazon Go/Starbucks combo location.

The Seattle-based e-tailer last week opened a 50,000-square-foot Amazon Fresh in Paramus, N.J., after opening a 47,000-square-foot store in Oceanside, N.Y., the week before. The two stores mark Amazon Fresh’s first New Jersey and New York locations.

In mid-May, Amazon had unveiled plans for Amazon Fresh to enter metro New York with new stores in Paramus and Oceanside, both of which would offer the company’s Just Walk Out cashierless shopping. Besides being the first Amazon Fresh in the Empire State, the Oceanside store — which occupies the space of a former Waldbaum’s supermarket — represents Amazon Fresh’s debut in the metro New York suburban market of Long Island. According to Newsday, two more Long Island Amazon Fresh stores are upcoming, in Plainview (a former Fairway Market store) and East Setauket (a former Waldbaum’s store).

More Amazon Fresh stores are upcoming for New York and New Jersey following the opening of the locations in Oceanside and Paramus.

Amazon Fresh’s store in Paramus also sits on a former Fairway Market site. In March 2020, Amazon acquired leases for Fairway’s Paramus and Woodland Park, N.J., stores via auction as part of the latter chain’s bankruptcy.

In announcing the openings of the Oceanside and Paramus stores, Amazon also said it opened a 50,000-square-foot Amazon Fresh in Norridge, Ill., the banner’s ninth location in Illinois, on July 14 and a 44,000-square-foot Amazon Fresh in Encino., Calif., the brand’s 16th in California, on July 21. Earlier this month, a 16,000-square-foot store opened in Arlington, Va., giving Amazon Fresh five stores in Virginia.

Overall, Amazon Fresh now has 39 U.S. stores in eight states and the District of Columbia. That’s more than double the 14 locations that Amazon Fresh had about a year earlier. Next after California and Illinois in number of Amazon Fresh stores are Virginia (five); Washington state (four locations); and Maryland, New Jersey, New York, Pennsylvania and D.C. at one apiece.

“Amazon’s grocery store expansion continues apace,” Coresight Research founder and CEO Deborah Weinswig wrote in her latest “Weinswig’s Weekly” column, released yesterday.

“Amazon Fresh is currently the most obvious manifestation of Amazon’s intentions in grocery and an acknowledgment that, to win share in this category, a substantial physical store presence is needed,” she explained. “For a long time, Amazon took a somewhat scattershot approach to grocery, with an abundance of online-only services and banners. We have seen some signs of reining in this array — Prime Now has been replaced by Amazon Fresh rapid delivery, and Prime Pantry has been closed. At the same time, we are seeing greater integration of stores and digital under Amazon Fresh (and also Whole Foods Market).”

The second Amazon Go Starbucks opened in The New York Times Building in Manhattan this month, and a third is planned this year for Times Square.

From local Amazon Fresh stores in selected areas, Prime members get free, same-day grocery delivery and pickup service, according to New York-based Coresight. At Amazon-owned Whole Foods Market, Prime members receive two-hour grocery delivery and free one-hour pickup at selected stores. The Amazon Go convenience stores don’t currently offer grocery delivery or pickup. A Coresight survey in March showed that 66% of Amazon grocery customers had used the Amazon website to order groceries over the previous 12 months, compared with 30% for Amazon.com’s Subscribe & Save service, 28% for Amazon Fresh rapid delivery and 27% for Amazon Fresh traditional scheduled delivery.

“In place of a surfeit of digital services, online and offline are being consolidated around the Amazon Fresh name, augmenting existing chains Amazon Go and Whole Foods. Reflecting the centrality of Fresh, Amazon used Prime Day to launch a new year-round benefit of 20% off the price of select everyday essentials at U.S. Amazon Fresh stores for Prime members,” Weinswig said in her column.

“Legacy store-based rivals have spent many years integrating digital and physical retail, yet this appears to be a work in progress for Amazon, with hints that it has not yet achieved complete channel-agnosticism,” she added. “We expect Amazon to continue to unify online and offline in grocery — effectively playing catchup with some longstanding rivals.”

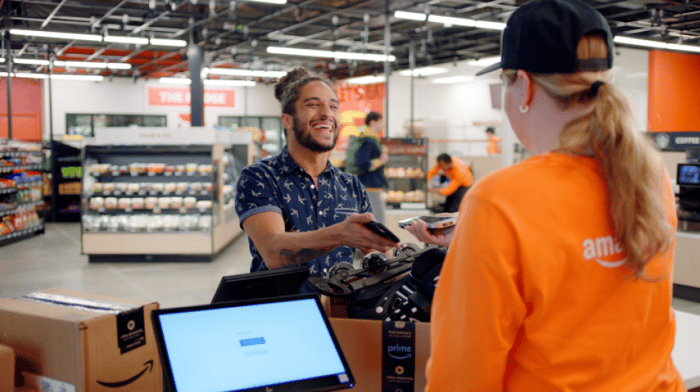

Technology will be a linchpin in helping Amazon catch up, Weinswig noted, citing the company’s Just Walk Out technology and Amazon Dash Cart “smart” shopping cart. Just Walk Out, which debuted at Amazon Go convenience stores, detects items taken off or removed from shelves while keeping a running total of the purchase, enabling shoppers to skip the checkout line. This year, Just Walk Out also was introduced at Whole Foods stores in Sherman Oaks, Calif., and Washington, D.C., with plans to deploy in more locations. And nearly two weeks ago, Amazon unveiled a new version of the Dash Cart, which provides additional functionality in keeping track of shoppers’ purchases, navigating the store, finding items, and completing their transaction while exiting the store, bypassing the checkout and self-checkout lines.

Amazon has launched a bigger-format Amazon Go for the suburbs, with the first opening in Mill Creek, Wash., and another planned for metro Los Angeles.

All five of the new Amazon Fresh stores opened this month offer Just Walk Out. Overall, 23 Amazon Fresh locations provide the service, with the remaining 16 stores offering the Dash Cart.

“The company’s Just Walk Out technology and Dash Carts remain a competitive advantage for Amazon. These technologies present an opportunity to deploy digital tools in stores to drive down friction and drive up convenience in the same way that pickup services have done across the industry,” Weinswig said, adding, “These integrations, coupled with aggressive store openings for Fresh, will make Amazon a much greater threat to grocery incumbents than its formerly fragmented and siloed offerings had done.”

Also this month, Amazon opened its second Amazon Go Starbucks outlet, located in Manhattan at The New York Times Building on 40th Street and 8th Avenue (620 8th Ave.).

The store combines a Starbucks Pickup site with an Amazon Go store, offering the full Starbucks menu and a curated assortment of food and beverages in the Amazon Go market, including fresh-made salads, sandwiches, baked goods and snacks. Customers, too, can use the order-ahead and pay feature in the Starbucks app as wells Amazon’s Just Walk Out technology for faster checkout. The modernized lounge area features individual workspaces and expanded tables.

The first Amazon Go Starbucks opened in November at 111 E. 59th St. on Manhattan’s Upper East Side. Another location is slated to open in New York City in Times Square.

In addition, Amazon has launched a larger-format Amazon Go cashierless c-store geared toward suburban markets. The first location, a 6,150-square-foot store in Mill Creek, Wash., opened in late April.

The new Amazon Go has front-of-store selling space of about 3,250 square feet, and the total size of more than 6,000 square feet makes the latest Go concept much bigger than the current 25 Amazon Go stores, which range from 450 to 2,700 square feet in the front end. The existing locations — in Chicago, New York, San Francisco and Seattle — also focus on high-traffic spaces in urban markets. When announcing the suburban Go format in January, Amazon said it also plans to open another location in metropolitan Los Angeles but didn’t provide details.

About the Author

You May Also Like