Labor issues and inflation remain top of mind for grocery retailers heading into 2023, according to Supermarket News’ third annual Retailer Expectations Survey.

The potential of a recession or a prolonged economic downturn in which consumer spending weakens could also be weighing on retailers’ outlook for the year ahead.

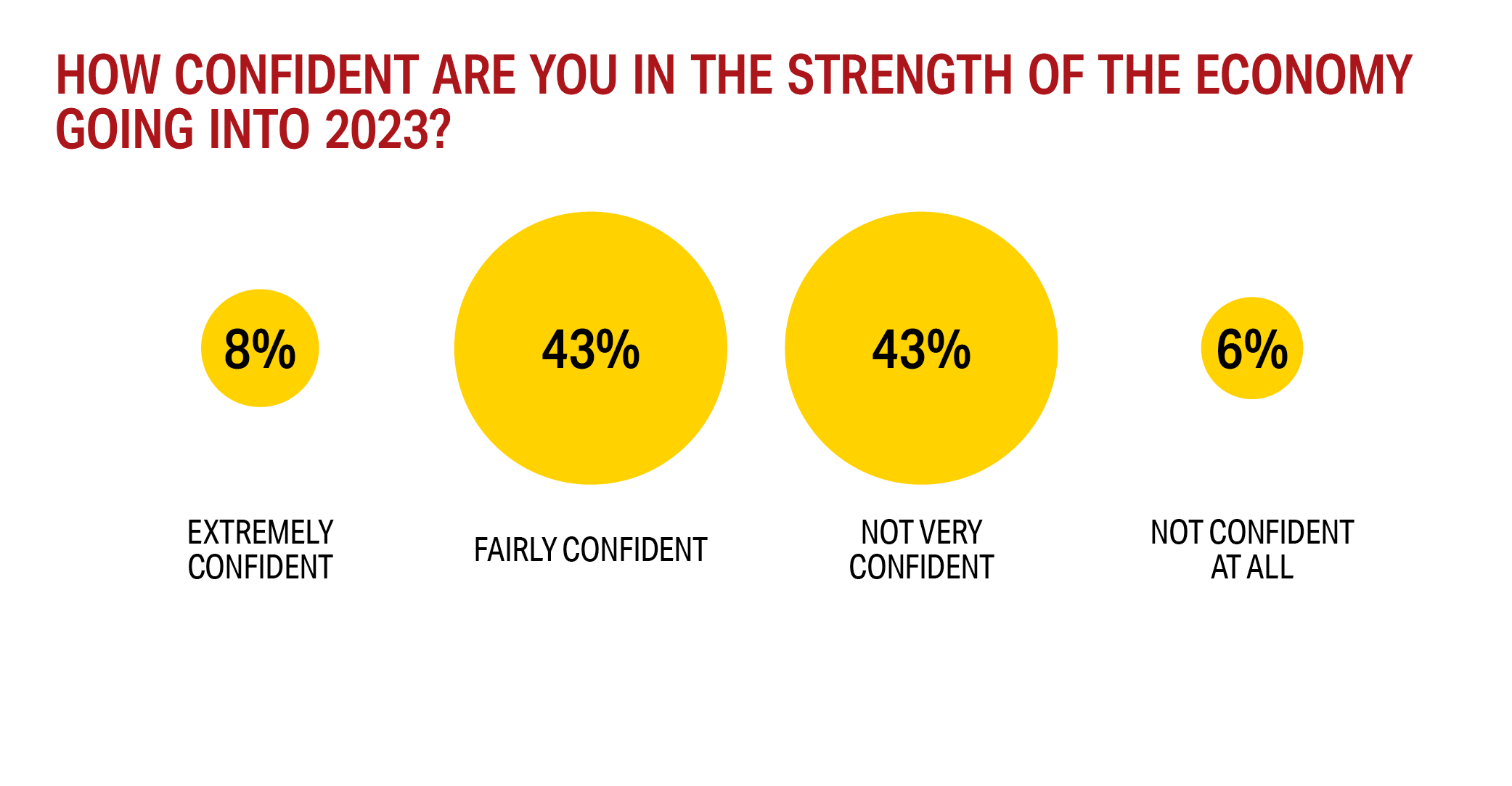

More than half of retailer and wholesaler respondents — 56% — said they were “not very confident” or “not confident at all” heading into the new year, compared with 44% who felt pessimistic about the economy heading into 2022. This is the third straight year that retailer/wholesaler confidence in the economy has declined.

Retailers’ forebodings about the new year are reflected in sales expectations, with nearly one in five — 18% — expecting sales to decrease in the first six months of 2023, compared with 12% who had forecasted a sales decrease in the first six months of 2022.

There were still a considerable number of retailers, however — 73% — who forecasted a sales increase for the first half of 2023, down only four percentage points from 77% in last year’s survey.

Retailer pessimism relative to a year ago is also reflected in expectations for unit expansion and hiring in 2023, both of which declined compared with the projections in last year’s survey. Only 27% of retailers said they plan to add stores in the year ahead, vs. 53% who planned to add stores in 2022.

Similarly, only 55% of retailers and wholesalers said they planned to increase hiring in 2023, while 75% had said they planned to do so in the year-ago survey.

BUILDING SALES IN 2023

Retailers are responding to the pressures they face with a focus on value offerings, including private label assortments, to appeal to budget-conscious consumers, and bolstering their fresh offerings, which often serve as a point of differentiation from lower-price competitors.

In this year’s survey, increasing private label leap-frogged to the No. 1 tactic retailers and wholesalers planned to deploy to grow sales, cited by 47% of retailers and wholesalers. It rose above last year’s top response—expanding fresh offerings—which was cited by 45% in this year’s survey, for second place on the list of sales-driving strategies.

Improving supply chain efficiencies (42%) and conducting more in-store promotions (34%) followed in the third and fourth position, although the percentages declined slightly for both, relative to a year ago.

This is also the second year in a row that the percentage of retailers planning to add or expand online grocery has declined significantly. This trend, perhaps, reflects the overall slowdown in grocery e-commerce demand since the pandemic, as well as the fact that many retailers may have already invested as much as they feel they need to in these services.

In this year’s survey, 24% said they plan to introduce or expand online grocery or delivery in 2023, vs. 46% a year ago. Only 21% said they plan to introduce or expand curbside pickup, down from 36% in last year’s survey.

The declines also come as retailers reported weaker e-commerce results in this year’s report than respondents anticipated last year. Only 23% of this year’s survey respondents reported that their online sales totaled more than 5% of total sales in 2022, compared with 43% who expected online sales to be that high in last year’s survey.

One survey respondent summed up their company’s plans to drive sales in the year ahead as efforts to “increase customer interactions, freshness, value pricing, and employee training.”

When asked how they plan to drive sales in 2023 retailers said:

• “2023 will be focused on bringing more value offerings to our customer base.”

• “Continued focus on fresh, organic and natural offerings.”

• “Expand deli/bakery departments.”

• “Expand meat and produce offerings to include more organic.”

• “Focus on fresh and best value for the customer.”

• “We need to strengthen fresh and create better excitement in the stores with center [store] displays to bring customers back.”

• “Social media, new website presence.”

• “We will be using more buy-one, get-one-free opportunities and will look to expand our basics program, where we keep staples at a lower margin than other groceries.”

CHALLENGES AND OPPORTUNITIES

Although some retailers have indicated in recent earnings calls that they expect inflation to slowly subside in 2023, it remains a significant concern for both retailers and wholesalers. Seventy percent agreed that inflation was a major concern, and 25% agreed somewhat, while the remaining 5% said they were neutral on the topic.

However, when asked what their biggest concern was in 2023, the top answer was “labor,” cited by 68% of retailers/wholesalers, beating out inflation/cost increases at 65%.

Other challenges included “supply chain issues” (57%) and “competition from other channels,” including online (35%).

“We have been able to maintain labor levels as a preferred employer in the community,” said one retailer. “We have no control over inflation or supply chain issues, and we don't see a massive improvement coming to the supply chain, although we do see inflation moderating next year.”

Other retailer/wholesaler responses reflected a mix of labor and inflation concerns:

• “Attracting help — not being able to offer the wages that chains and multi-store owners can.”

• “Finding and retaining associates is our biggest challenge.”

• “Inflation is impacting customer shopping behavior, already causing channel shift and trading down.”

• “Inflation and higher costs will be a real challenge for our business.”

CATEGORY OUTLOOK

Retailers and wholesalers are the most bullish on their fresh produce offerings in 2023, with 63% citing it as the category they expect to have the most success with. Fresh meat was a distant second in terms of garnering retailer optimism, at 42%.

Interestingly, fresh meat was also the category that retailers expected to present the biggest challenges, cited by 48% of retailer/wholesaler respondents, beating out both center store and health and wellness/HBC, both which were predicted to be a significant challenge by 33% of respondents.

One possible explanation for fresh meat’s position as both a challenge and an opportunity could be the unpredictability of pricing and inflation on fresh meat items, and the impact that an economic downturn could have on the category.

INVESTING IN PREPARED FOODS

The deli/prepared foods department remains an important area of focus for retailers, where they can often drive strong margins and satisfy customers seeking convenient, affordable meal solutions.

Fifty percent of retailers in this year’s survey said they planned to increase their prepared foods offering in 2023, up slightly from 48% a year ago. Even more retailers (59%) plan to alter or change their prepared foods menu—with more grab-and go, for example—a significant increase from 45% who planned to do so last year.

“We are moving toward more grab and go,” said one retailer.

Other responses about plans for the prepared foods offering included:

• “Expand the department and add pizza.”

• “Demand is there; increase can only happen if we can fill vacant shifts.”

• “Increase our prepared food selection.”

• “Keep best sellers and rotate seasonally other offerings.”

• “More shelf-life products.”

• “We intend to expand as we are about to move into a new commissary facility in January of 2023.”

Undoubtedly, retailers will find ways to innovate and navigate whatever challenges lie ahead in 2023. Stay tuned.